Many businesses face huge swings in demand over the course of a week, a month or a year. This can be especially difficult for businesses with inelastic supply and high fixed costs, like airlines, hotels and golf courses. Revenue management is the art and science of predicting those swings in demand and responding in a way that maximises the business’s revenue. This article outlines the basic principles of revenue management along with strategies and tips for becoming a good revenue manager.

What Is Revenue Management?

Revenue management is the practice of applying data and analytics to predict demand and adjust pricing — and, in some cases, other terms of sale — to maximise revenue from the business’s underlying inventory/supply. Revenue management has been called the art and science of “selling the right product to the right customer at the right price”. Some definitions include additional qualifiers — such as “at the right time” or “through the right channels” — but the core premise is the same: varying how you sell a product or service to meet the constantly changing needs of the market’s buyers.

Revenue management is more than just figuring out what price to charge. With revenue management, the right price is often more a function of the needs of potential customers than the economics of the product. So, for example, businesses where cost-plus pricing (adding a consistent margin to the cost of producing the product) works well might not need a process as sophisticated as revenue management. Industries with high fixed costs and low marginal costs are the most common users of revenue management. These industries tend to be in the travel and hospitality sectors: Hotels, airlines, golf courses and car rental agencies are some examples of businesses that make heavy use of revenue management to set prices and other sales terms.

Revenue Management vs. Yield Management

These are related concepts; in fact, some consider yield management to be a type of revenue management that focuses on clearing inventory. Clearing inventory through yield management requires the following two points to be true, the presence of which is also useful when applying any kind of revenue management techniques:

-

There’s a fixed amount of what you’re selling — in other words, a “depletable” inventory, such as the rounds of golf a country club can sell in one day on a single course.

-

What you’re selling expires. This isn’t necessarily literal; inventory may expire in the way a round of golf tomorrow can’t be sold the day after. The point is, when the unsold inventory expires, it’s worthless.

Some people add a third condition, which, while not strictly necessary for yield management, is required for any analysis more complicated than “find the right prices”:

-

Differences in customers’ willingness to pay for what you’re selling must be correlated with something the business can use to segment its offerings. On our hypothetical golf course, for example, perhaps weekday customers are willing to pay more than weekend golfers because they’re mostly paying from business expense accounts, or maybe weekday customers want to pay less because they’re retirees on fixed incomes who happen to have more time for midweek rounds. Whichever way it goes, the point is to establish different selling terms based on the segmentation.

Revenue and Yield Management Key Differences

Revenue management is broader than yield management — it allows for longer-term approaches to maximising revenue and delivering value to customers, whereas yield management is about optimising what you can get out of a fixed inventory. A business can apply revenue management practices where yield management assumptions don’t hold true by focusing on more revenue-generating variables than simply sales of inventory. The inventory-centric yield management approach also ignores opportunities to improve ancillary revenue that varies by customer type, such as which golfers tend to buy items in the pro shop or which hotel guests are most likely to eat in the restaurant.

That said, yield management practices are at the core of many revenue management strategies. You may want to think of revenue management as a broader strategic approach, with yield management containing a particularly useful set of tactics you can employ toward your goals.

Key Takeaways

- Revenue management lets businesses treat individual days like separate micro-markets, with their own supply-and-demand curves.

- Good information — about the business, customers, competitors and the calendar — is essential to revenue management.

- While revenue management can be a highly quantitative practice, a numbers-only approach isn’t always the right long-term strategy.

- For some businesses, revenue management is the difference between success and failure.

Revenue Management Explained

In practice, success in revenue management is all about collecting and analysing high-quality information. A good revenue manager must possess detailed information about their offerings, customers, calendar and competitive market.

Knowing your offerings means not only your inventory but also what you can do with it. A hotel room night, for example, might be sold by itself, as part of a longer stay or as part of a room block for a conference or wedding.

Knowing your customers is essential to predicting demand, including several different aspects of demand. Business travellers are different from leisure travellers and will respond differently to promotions, events, seasons and even the day of the week. Conventional wisdom suggests that leisure travellers book further in advance than business travellers, though there are certainly spontaneous leisure travellers who look for last-minute deals.

That feeds directly into knowing the calendar. If a hotel primarily caters to business travellers, demand may be higher during the week, but a beach resort may see higher demand on the weekend. That same beach resort may see higher demand in the summer than winter, but then high demand, again, around the holidays. All of these factors interact: For example, what will demand be like for a summer holiday weekend? Infrequent and irregular events are also important. A major political party’s nominating convention can result in sold-out hotel rooms citywide, regular festivals and events bring in large crowds and even smaller happenings may bring in unexpected customers that represent an excellent opportunity for revenue managers with a keen eye. Special exhibits at art museums have been known to create demand for hundreds of hotel room nights spread out over many weeks or longer. Such calendar events can create wild swings in demand, along with subtle opportunities to attract a particular customer type. In that case, the key questions become: What can you offer to appeal to that customer type and how can you advertise to reach them better than the competition?

And that leads to knowing your market. The first step to knowing your market is knowing your competitors and “comparables” — substitutes that exist for what you’re selling (e.g., a hotel needs to know other hotels but may also keep an eye on short-term home rentals or local campsites). Which comparables are relevant is defined by customers’ preferences. The next step is collecting pricing information for the “comps” (shorthand for comparables, competitors or both). Chances are prices are available online. Sometimes you’ll use competitor prices tactically — can you undercut a close competitor or justify a price premium? Sometimes competitor prices may help you avoid a mistake. For example, if everyone is charging three times your rate, you probably missed an event on the calendar.

Having all of this information not only helps set prices, but it can help establish constraints as well. For example, a sharp revenue manager may not want to sell out all hotel rooms in advance of a big weekend event because experience suggests some guests will be willing to pay a lot more at the last minute. Or a beach resort selling room nights over a popular three-day weekend may not want to offer the middle night for one-night stays, as it will make it harder to fill that room on the other two nights. Alternatively, the resort could raise the price of one-night stays to adjust for the risk of an empty room on a popular night.

Why Is Revenue Management Important?

Revenue management helps businesses get the most out of what they have to sell, offer specific deals to customers who value them the most and capitalise on opportunities in a way fixed pricing never could. But even more than that, some businesses wouldn’t even exist without revenue management — it can be the deciding factor that lets a business offer products to customers at all.

Take, for example, a hotel in a popular weekend spot. During the week, it can only charge $100 per night if it wants to fill a room. On weekends, it can charge $300 per night. Without revenue management, a $100 room night price would bring in $700 per week assuming the room is filled each night. A $300 room night price would bring in $600 per week, leaving the room vacant most nights. Now, if the hotel needs a room to bring in $800 per week to operate, it can’t stay in business. But with revenue management, the hotel can make $1,100 per week on that room by charging $100 on the five weekday nights and $300 on Friday and Saturday nights.

That logic applies to any business with high fixed costs and low variable costs. For such businesses, operating at all is costly, but serving an extra customer when capacity is available becomes very inexpensive.

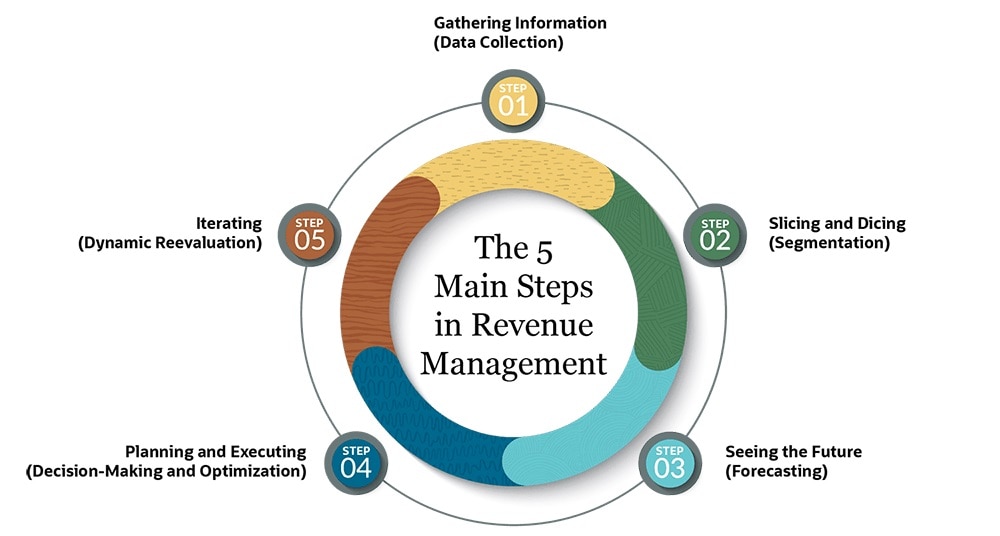

5 Revenue Management Steps

When approaching revenue management, it helps to have a systemised process. In practice, the five steps described below can be ongoing and concurrent, but having a clear progression that takes you from gathering information to making decisions is what makes revenue management, well, manageable.

-

Gathering information (data collection): In this step, you’ll want to collect as much relevant information as you can. It helps to focus on the following four key areas, though that’s not to say relevant information won’t exist outside of this framework.

- Know your offerings: What are you selling? What ways can you sell them?

- Know your customers: This includes regular customers and potential customers. Who are you trying to reach? What do you know about them?

- Know your calendar: Every season, every week, every weekend and even every day can be thought of as its own micro-market.

- Know your market: Collect enough information about competitors and comparables (substitutes) to know your potential customers’ entire choice set — not just what your offerings look like to them.

- Know your history: What do you know about the history of everything above? How do things usually go for a particular day/month/event? What can you learn from past experiences? What are your customers used to? What past strategies worked and didn’t, and do you know why?

-

Slicing and dicing (segmentation): After step 1, you have a lot of data that can be broken down in 1,000 different ways. The question isn’t about which is the “right” way to do it, but what are the useful ways to partition the data? If you know that customers who buy at the last minute don’t care as much about price, on any given day you can divide your offerings in time, with prices higher for closer dates. If weekend customers are different from weekday customers, or Monday morning customers are almost all business travellers (true enough for many airline routes), you can segment by day of the week (and for the airline example, even time of day). If a recurring promotion has loyal fans who wait for it, make room for those customers who are a great source of reliable repeat business. Use what you know to divide customers and calendar into useful segments, which in turn helps manage your offerings.

-

Seeing the future (forecasting): Using newly collected data, the precision gained through useful segmentation and historical data, you can start forecasting demand over time and by customer type. Sometimes this is a simple process involving a baseline (e.g., how things have been going recently or what happened at the same time last year) plus adjustments based on new learnings. But forecasting can also be as complicated as you want to make it — sometimes it’s an automated computational process using regression techniques on time series data with influencing effects from your data collection. The trick is to make sure the added benefit of a more detailed and sophisticated model is worth the effort it takes to generate.

One useful source of input data for your forecasts is output from other forecasts. Forecasts about the weather, consumer behaviour and general economic trends can be useful in determining how your industry as a whole will fare and, from there, how that will impact your particular competitive position.

As with all forecasting, remember: garbage in, garbage out. No matter how sophisticated and excellent the forecasting model is, if the information put into it is low-quality and unreliable, the resulting forecasts won’t be reliable either. It’s tempting to spend a lot of effort investing in excellent forecasting capabilities, but that must be matched by good data collection or else the forecasting is all for show.

-

Planning and executing (decision-making and optimisation): Forecasting can shine a light on what customers, competitors and industries will do. In this step, it’s time to decide what your business should do. With detailed forecasts about how many customers of which type are going to consider your business’s offerings on a given day, you can mathematically calculate the revenue-maximising response. Optimisation can be complicated, but many revenue management systems offer proven, built-in optimisation formulas. With these capabilities in hand, the question becomes: Should you simply execute the revenue-maximising strategy that the math dictates? The answer: Sometimes, but probably not always.

It’s important to remember that while the math is proven, the real-world data being fed into the formulas is never perfect. Your forecasts and understanding of the demand curves are guesses, subject to error. So instead of just trying to maximise expected value, you also want to manage deviations from that expected value — in other words, minimise downside risk while pursuing some opportunities with high potential upside, even if they cannot be forecasted with high accuracy.

There are a few important questions to ask when deciding how closely to follow the forecasted optimised prices. First, is setting prices too high substantially more or less risky than setting them too low? If the risk is asymmetric — one way is far riskier than the other — you may want to adjust prices to err on the side of caution.

Second, is there important information the forecasts couldn’t account for? Hotels underneath a rare solar eclipse, for example, tend to sell out on the night of the event. When tens of thousands of tourists descended on the Western Australian town of Exmouth to view a total solar eclipse in April 2023, accommodation was at a premium. If hotels in the area had not factored the solar eclipse and the resulting surge in business into their prices when tourists began booking — many some years earlier — they would have missed out on potential revenue.

Third, are there long-term considerations that outweigh short-term revenue optimisation? A luxury product may have a brand to protect, and managers could worry that pricing too low may undercut their ability to command a premium going forward. With enough time and specificity, some of these extra considerations can be incorporated into data and forecasts, but human judgement still has an important role to play alongside mathematical optimisation in the planning and execution of revenue management strategies.

If there’s one thing to take away from these steps, it’s, again, that everything depends on the quality of the data. Business activities that bring in valuable information about customers and potential customers (e.g., an experimental promotion you can’t forecast) may not immediately translate to revenue increases, but they have the potential to steer the future of your business.

-

Iterating (dynamic reevaluation): In reality, a revenue management department will be cycling through all of these steps every day. At the same time, they’ll be seeing results from past cycles coming in. It’s important to learn what worked, what didn’t and — most importantly — why. Sometimes when a strategy doesn’t pay off, it will be because of poor process execution. Or maybe one week a competitor simply outplayed you. But sometimes it’s because customers have changed and your old understanding is no longer true. This may be an early sign that important changes are needed elsewhere in the business. A good revenue management process will make room for learning and adaptation. How many articles have been published about millennials “killing” some company, product or industry? That’s an unhelpful framing for an important truth: Competitive businesses that don’t listen to what their customers want and note how they’re changing don’t succeed.

Revenue management is a continuously iterative process of gathering information about various customer types, analysing it to forecast their behaviour, offering prices and other terms to maximise revenue by exploiting those behaviours, evaluating the results and making adjustments.

History of Revenue Management

One could quibble over its exact origins, but many scholars and business writers have coalesced around one 1970s story as the beginning of modern revenue management: when BOAC, a predecessor to British Airways, first offered “early-bird bookings”. BOAC noticed that leisure travellers were more price-sensitive and tended to book earlier than business travellers. So it offered a discount for booking more than three weeks ahead of time, with prices attractive to more leisure travellers. Meanwhile, most business travellers continued paying the higher price.

While successful, this strategy raised some potential issues. How many seats would be available for the discounted price? If prices were altered without controlling inventory, BOAC risked filling a plane with leisure travellers and missing out on higher revenue from business travellers, who were its most frequent fliers. But if it didn’t offer enough seats at a discount and a plane flew with empty seats, that ticket would expire with no value to anyone. The question of how many seats to make available at the discounted price also had no straightforward answer — the season, the day of the week and the time of day all made a difference. Leisure travellers tend not to fly out Monday morning, while business travellers were more likely to fly between big cities than to communities with many resorts and spas. With airlines, there’s the added complication that not every occupied seat flying between City A and City B gets occupied by a passenger whose origin is City A and whose destination is City B. Flights can be legs in an itinerary, so if a route (say, to London) is full of passengers making connections, you could have dozens of different itineraries on one aircraft at one moment.

What started as a simple promotion, one successful enough to be emulated by others, grew into what we now know as revenue management. It jumped from airlines to hotels to many other industries, each of which adapted the practices to its own idiosyncrasies. Most industries don’t have “legs” of an itinerary (though railways do), but hotels added their own considerations like length of stay — the logic and mechanics of which are also used by car rental agencies. The introduction of computers dramatically increased what revenue management could do. Today, the advent of artificial intelligence may once again revolutionise how businesses tailor offerings to different customers.

Revenue Management KPIs and Metrics

Revenue management has some common financial key performance indicators (KPIs) and metrics, but of utmost importance is to find the KPIs that work best for your business and situation. These are examples, not a comprehensive menu from which to assemble a dashboard.

- Average daily rate: This is common in hotel and rental businesses. It’s the average revenue per unit per day. It ignores other sources of income and unrented periods, and can be an indicator of the pricing power of a core offering. For rentals that aren’t rented by the day, substitute the appropriate time period (hour, week, etc.).

- Occupancy: This measures how full a hotel is, though the concept can generalise to other rental businesses as, simply, the percentage of units rented at any given time. Related, average occupancy is the occupancy measure over time instead of at a point in time.

- RevPAR (revenue per available room): This is perhaps the most important go-to metric in the hotel industry, and it combines the previous two concepts. It tells how much revenue each room is generating and includes nights a room sits empty. Again, you can generalise this metric for any rental business, thinking of it as “revenue per available unit”.

- ARPA (average revenue per account): The ARPA KPI takes a different perspective than the previous metrics: It looks at revenue per customer account rather than per asset. It’s usually calculated as monthly recurring revenue divided by the number of accounts generating that revenue.

- Profit per unit: This comes in many forms (profit per room, per airplane, per vehicle) and many different measures of profit. In the hotel industry, GOPPAR (gross operating profit per available room) is most common, but it’s easily adapted to other industries. Many businesses using revenue management techniques have high revenues and high costs, so focusing only on the revenue side can lead to an overly optimistic view.

- PRASM (passenger revenue per available seat mile): This is the revenue management KPI for the passenger airline industry. It takes passenger revenue (ignoring revenue from things like cargo and credit card loyalty programs) and divides it by the total number of miles travelled by each seat in an airline’s fleet. Seat miles are correlated with fuel burn and time in the air (and therefore wages paid for work in the air), two of an airline’s biggest cost drivers, and they’re a good measurement of an airline’s capacity for delivering travel to customers. This metric goes down when seats fly empty, accounting for the lost opportunity.

- Other accounting and financial metrics: Revenue management KPIs can also include a variety of standard accounting metrics, like total revenue and EBITDA (earnings before interest, taxes, depreciation and amortisation). Not every metric has to be special or customised like PRASM or RevPAR.

- Your metric here: Knowing your business and what matters to it, what metric really captures what you’re going for? What summary statistic goes up when the business does well and goes down when things go south? Think carefully about what you really want to measure, manage and have business teams care about. That’s the metric you want.

Revenue Management Strategies

When most people talk about revenue management strategies, they start with price. But too much focus on price can leave extremely valuable tools underused or unused. So before focusing on price — in the next section — here are a few revenue management strategies that don’t involve changing prices:

- Inventory controls: Don’t make every room night, tee time or flight available for purchase all at once. You can hold some back as you learn more about the micro-market for that day as it draws closer. You can also block off enough inventory for large bookings by continuously coordinating with the relevant sales teams to figure out when there will be a big event (like a wedding, conference, corporate golf outing or even a church retreat).

- Distribution channel controls: Ideally, every customer would buy directly from your website. But in travel and hospitality, aggregators and marketplaces have taken a chunk of the customer base and, with it, a percentage of the revenue. Whether selling through the likes of Flight Centre, Klook, Expedia, or something else, thinking through how much to offer and under what terms is a decision you can’t make lightly. You don’t want to sell out through a service that takes a commission and be left without inventory for customers on your website, but you also might not want to ignore the large boost in visibility you can get by participating on these platforms. Hotels in particular are known for offering non-price incentives for their most loyal customers to book on their websites or through their apps, typically through loyalty program incentives (e.g., you can’t earn points or use your elite status benefits if you don’t book with them).

- Duration controls: Remember the earlier example about a beach resort selling room nights over a popular three-day weekend? Selling the middle night for a one-night stay could make it harder to fill that room on the other two nights. One possible way around this problem is by requiring a minimum length of stay, either around a special event or even all the time.

- Married segments: This is a term from the airline industry, but it applies to any transportation service offering multileg itineraries. Two segments of an itinerary can be “married” if they are sold together, and they might not be available separately. Airlines that have crowded flights coming into major hubs and flights departing soon after that are empty may not want to sell the scarce inbound seats to customers travelling only to the hub city. Instead, they might prefer to wait for a customer who will use that seat to build a longer itinerary — or, at the very least, charge the customer taking a shorter trip enough to account for the lost opportunity of selling a connecting itinerary.

Revenue Management Pricing Strategies

Pricing, of course, has spawned a variety of strategies for optimising revenue management. Here’s a sampling of five:

- Open pricing: Open pricing is a policy that allows revenue managers to dynamically set prices with maximum flexibility. They can change prices dynamically in real time without having to worry about syncing pricing across, for example, room types, dates, distribution channels or lengths of stay. A word of caution when implementing this: Sometimes contracts with distribution channels prohibit truly open pricing. So to give revenue managers open pricing freedom requires systems in place to ensure compliance with those constraints.

- Forecast pricing: Forecast pricing is used to set custom prices far in advance, as opposed to regular or standard seasonal rates. A forecast pricing approach requires not only predicting what demand will be on a given day far in the future, but also what competitors might do and what events might impact demand. It must also account for customer type — when you set prices far into the future, you’re specifically making offerings to the customer types who book far in advance.

- Guest-segment pricing: In this strategy, the business charges different prices to different types of guests for essentially the same thing. It’s the most direct form of price discrimination in revenue management, and therefore it’s important to make sure that any guest-segment pricing strategy complies with local laws as well as general ethical principles. For example, it’s not uncommon to find discounts for senior citizens in places like Australia and Singapore, but price variations based on something like race would be frowned upon and potentially illegal.. With that disclaimer understood, segmenting promotions by guest type can be a good way to reach out to customer types who might not typically consider you. For example, a hotel that prices suites at several multiples of the regular room rate might consider offering those same accommodations with all their extra space at a family discount to encourage leisure travellers who wouldn’t otherwise consider the hotel.

- Length of stay: Similar to duration controls, length-of-stay pricing sets prices in ways that encourage longer stays. You can think of this as a volume discount, except instead of renting more rooms the customer is buying more room-nights. This way the same night in the same room (or the same day in the same rental car) might have a different price depending on when the customer arrives and leaves.

- Competition-driven pricing: An important strategic decision to make is the extent to which a revenue manager wants to set prices based on competitors’ prices. Price matching is the most extreme form of this strategy, though using competitor prices to set guideposts can be useful. For example, a midtier hotel may want to make sure it’s never more expensive than a nearby luxury property, though perhaps that rule gets broken when hosting a conference for attendees who value convenience more than product quality. Another competition-driven pricing strategy would be to explicitly undercut nearby competitors by a little bit, hoping to attract customers who are searching for options using price as their most important factor.

Revenue Management Tips

There are entire college courses in revenue management, so one article (even this very long one) can’t teach you everything there is to know. But here are some general tips to help you succeed at revenue management in any industry.

- Always be learning. Revenue management is about making the most of available information. No one has perfect information, and no one has perfect methods for processing that information. If information and know-how are competitive advantages, the fastest learners will be the best revenue managers.

- Don’t be afraid to experiment. Information has value, and sometimes the only way to learn important things about a market is to try them out. A few thousand dollars of missed opportunity or promotional giveaways might be a bargain if the trade-off is learning valuable information about what customers want and how they make decisions.

- Collaborate. Don’t work alone. Businesses that use revenue management have a lot of departments handling things like sales, promotions, retention, customer service, loyalty, technology, operations and more. All work toward the same goal: to make money by providing value to customers. Don’t keep valuable lessons about customers to yourself, and try your best to learn from others.

- Think long term. The practices of revenue management tend to promote short-term thinking. You’re rarely selling something more than a year ahead of time, and hard metrics are coming in every day to which you have to respond. That’s important. But it isn’t everything. Don’t forget to think long term — you’re not just setting prices, you’re collaboratively building a business and a brand. The urge to squeeze out every last dollar is strong (and explicit in some organisations), but take a moment to think about how your strategy works long term. Unless the business has some kind of market failure-style protection, like a natural monopoly, leaving customers happy is almost always more important than the marginal dollar. Keep one eye on the horizon.

Revenue Management System Features

A revenue management system (RMS) is a software product that assists with, tracks and sometimes even automates many of the practices discussed in this article. Here are some features a good RMS should offer.

- KPI tracking: A good RMS will help track key performance indicators and metrics for revenue managers. It should provide updated metrics on where you are now, where you’ve been and allow you to calculate metrics over various periods of time.

- Competitor pricing: In the data collection phase, part of “knowing your market” is knowing what competitors are charging. If competitors are in a well-known industry that puts pricing data online, a top-rate RMS will gather some of that information for you. It might not sign up for your competitor’s emails and let you know about special promotions, but it can do the basic job of scanning what they’re charging and when.

- Restriction management: There’s no standard term for this, but a good RMS will account for rules and restrictions, either rules custom-made by you to prevent errors from occurring, restrictions imposed by things like contracts with distribution channels or requirements from a larger corporate owner.

- Revenue estimates: With perfect data on what you’re charging, when and approximate forecasts for what you think demand will be — which an RMS can help you develop as well — the software will often be able to estimate what your revenue will be going forward. You can use this for “what if” analysis, but remember that the predictions are only as good as the data, assumptions and forecasts upon which they’re based.

- Pricing recommendations: This is one of the most important things an RMS can do, especially for smaller teams and those without a lot of quantitative firepower. You can reinvent the wheel of running complex models and algorithms, or you can use models that have been vetted and come with your RMS. At the very least it gives you a starting place with suggested prices, and you can apply your own analysis and knowledge to make adjustments from there.

Keep in mind that software can only use information you give it or tell it where to find. It can’t scan calendars or read news stories and predict how humans will respond (yet). An RMS will be better at processing large numerical datasets than you ever could, but a revenue manager’s job is to also incorporate information that isn’t easily fed into the software.

Choosing A Revenue Management System

The most important thing to consider when choosing a revenue management system is how closely your business resembles the businesses the RMS was designed to help. Revenue management looks different in different industries, and while the principles and core logic are largely the same, the industry-specific elements are still substantial in practice. Don’t try to force a square peg into a round hole; get something that’s as close as possible built for your industry.

Many sources will speak with authority about what you need in a revenue management system, but bells and whistles are meaningless without a plan behind them. Sophisticated analytics are great, but only if you can use them. Many users love cloud technology for data security and easy software updates, while other businesses already have solutions for storing and securing data in place and prefer not to have to deal with software that changes frequently. Most users want help running optimisation algorithms and suggesting prices from their RMS, but if your business works best with a simpler approach — and many do — it’s not worth paying for premium capabilities you won’t use. When choosing a revenue management system, the goal is to find the best fit.

Conclusion

Many businesses face huge swings in demand over the course of a week, month or year, and the world is only getting more variable. It’s hard for many businesses to prepare for and respond to these shifts in their customer needs — and sometimes shifts in who their customers are. Revenue management software can be an essential tool for meeting customers’ needs and providing them with the right product or service, at the right price and the right time.

#1 Cloud

Accounting

Software

Revenue Management FAQs

What are revenue management strategies?

Revenue management strategies are strategies that help a business set prices and tailor offerings to their potential customers. Such strategies can range from very general, such as market research methods for understanding customers or time series analysis techniques for demand forecasting, to very specific and tactical, such as enforcing minimum lengths of stay on holiday weekends at hotels.

What is revenue management in a hotel?

Hotels are one of the most common users of revenue management techniques, and many hotels depend on revenue management just to stay in business. Hotel revenue managers forecast demand and set competitive prices to attract customers, sometimes treating each day as its own micro-market with a unique supply-and-demand curve.

What is the role of a revenue manager?

A revenue manager uses data analytics to forecast demand and then steer a business’s selling strategy. The selling strategy includes pricing — often the biggest and most important part of the job — managing third-party distribution channels, inventory control and any applicable rules, like minimum lengths of stay at a hotel or “married segments” in airline and other transportation businesses’ itineraries.