For some companies, going public is the hallmark of success. But transitioning into a publicly traded enterprise is an expensive and demanding process, rife with regulatory complexities — and with no guarantee of success. Before a company can even consider releasing an initial public offering (IPO), it must be well prepared and have its financial reporting shipshape to comply with stringent regulations.

Still, despite those hurdles, hundreds of firms go public each year. Despite a challenging year in the midst of the pandemic, 2021 saw a total of 2,388 deals worldwide, raising US$453.3b in proceeds — a 64 per cent and 67 per cent respective increase YOY. The APAC region contributed nearly half of these, with 1,108 IPOs raising US$162b according to PwC.

What Is an Initial Public Offering (IPO)?

An initial public offering, or IPO, is when a private corporation issues its first stock shares on the public market, raising capital from public investors. This means that the company becomes a publicly traded and owned entity, and funding is no longer limited to private investors; anyone can eventually buy stock in the company if they so choose.

Colloquially, this process is known as “going public.”

Because going public can be so arduous, in recent years increasing numbers of private companies have opted to do so through special purpose acquisition companies (SPACs), instead of directly releasing an IPO.

IPO vs SPAC

A SPAC is a shell company that goes public with the intent to raise enough money to acquire an existing private company. This makes it easier for the private company to go public, because the SPAC is already public when it makes the acquisition. The SPAC does not make or sell any products or services and, according to the Australian Securities and Exchange Commission, a SPAC’s only assets are the money raised in its own IPO — earning SPACs the nickname “blank-cheque companies.”

While SPACs started in the US, the investment vehicle has gained momentum in the APAC region, with a number of markets in the active consultation process. The Singapore Exchange is the first APAC financial hub to welcome SPACs, with three making their debuts in January 2022.

Key Takeaways

- For many companies, an IPO is a prestigious mark of success.

- The transition from private to public is a long, complex and costly process.

- Going public has financial advantages, but businesses must follow rigorous regulations, and the IPO is not guaranteed to succeed.

- Accounting software can ease the transition from private to public by keeping financials accurate, up-to-date and compliant with regulations.

Initial Public Offerings (IPOs) Explained

When a company releases an IPO, the owners give up part of their ownership to stockholders. Company shares can then be traded on a public stock exchange like the Australian Stock Exchange (ASX), Singapore Exchange (SGX) or the Stock Exchange of Hong Kong (HKEX).

Going public is a big step and represents an opportunity to use the large amount of capital an organisation may raise to grow and expand. Releasing an IPO is also an important moment for private investors — like the business’s founders, family and friends, venture capitalists and angel investors — whose shares become more liquid and, usually, more valuable.

Any business can go public through an IPO, but it’s important to note that not all companies are suited for the public eye. Some may not be financially ready, whereas others may benefit from waiting for a more opportune moment — either in their own development or in the market’s attitude toward IPOs, which tends to fluctuate. No matter what, business leaders must assess the cost, time, requirements and implications of releasing an IPO.

If an IPO is the right move for a company, the next step is to seek assistance from underwriters, who play a key role in managing the complex process by acting as consultants, preparing necessary documents and setting initial IPO prices, among other responsibilities.

How Initial Public Offerings (IPOs) Work

IPOs are time-consuming, with successful efforts taking an average of two years to execute. This is largely because companies need to be mature enough to meet rigorous financial regulator and underwriter requirements.

If a company deems itself ready for an IPO, it will team up with an investment bank, or banks, to underwrite the IPO. Underwriters help the company adhere to all local market and stock exchange regulations, and make key decisions, like share price and the number of shares that will be issued.

Underwriters also become the initial owners of newly issued shares and take legal responsibility for them. At this stage, a prospectus is prepared. Typically written by the company’s legal team with input from management and underwriters, the prospectus explains the business and how it works. It also discloses financial information, who the underwriters are and the possible risks inherent in investing in the business. Local regulators will require a prospectus as part of an IPO — they’re public documents meant to help investors make more informed investment decisions.

Once an IPO is set, the company publishes a press release to confirm the total number of shares being offered, the share price and the date on which public trading will commence. On that day, millions of investors — individuals and institutional investors — can buy shares in the company, and existing private shareholders’ shares become worth the public trading price. Such company insiders are free to hold on to their stock or trade it, typically after a “lock-up” period of 24 months for Australia and 6-12 months for Singapore.

Throughout the IPO process, companies can expect to pay legal, accounting, marketing and underwriting costs.

Why Do Businesses Go Public?

The primary reason businesses go public is to raise capital. That cash infusion often funds growth initiatives, but it may also be used for debt payments, research and development, a mass marketing and advertising campaign or anything else a company feels it needs to get to the next level.

What’s more, a successful IPO can increase a business’s prestige and public image, and the required quarterly financial reporting provides transparency that can help businesses secure better borrowing terms, including lower interest rates.

History of Initial Public Offerings (IPOs)

Many historians and economists say the practice of issuing public shares dates back to the Roman Republic. State contractors, known as publicani, were legal bodies whose ownership was divided into two types of shares: larger executive shareholdings and smaller, more informal shares that could be traded. Couriers collected information to help determine how much shares should be worth.

Modern IPOs have been an important part of the business world since 1602, when the Dutch East India Company issued shares to the public to help raise capital, making it the first publicly traded company in history. The company raised 6.5 million Dutch guilders, and dividends averaged around 18 per cent of capital over the course of the company’s 200-year history.

The first IPO in the U.S. took place during the Revolutionary War, in 1781, when the Bank of North America publicly issued 1,000 shares priced at US$400 each. About a decade later, the New York Stock Exchange was founded.

Ever since, IPOs have had a volatile history. They go in and out of style based on factors like industry trends, emerging technologies and economic conditions. For example, tech IPOs took off in the famous dot-com boom of the late 1990s, when the promise of new technology — the internet — seemed so transformative that entrepreneurs were able to start companies and go public before they became profitable or even, in some cases, before they had revenue. When the dot-com bubble burst in March 2000, IPOs ground to a near-halt for several years. That happened again in 2008 and 2009 during the Global Financial Crisis, but since then IPOs have come back into fashion, with 2021 marking a record-breaking year in which 240 IPOs were released in the Australian market — more than three times the number tallied in 2020 and far more than a decade prior.

Advantages and Disadvantages of an IPO

While IPOs have a number of benefits, there are also risks and disadvantages to consider. Going public will not be the right decision for every company.

IPO Advantages include:

-

Fundraising: Perhaps the biggest benefit of an IPO is the ability to quickly gain more capital that can be used to fuel healthy growth. An IPO is often the only way a company with great ambition and/or intense capital needs can secure enough cash to expand and comfortably afford to hire new employees, invest in new equipment, pay off debt or even acquire another business.

-

Prestige: If a company wants to grow, it must also expand its profile. Going public can boost a company’s public image, making it easier to attract top talent, gain new customers and raise capital to invest in future operations.

-

Cashing in on hard work: Any company that goes public likely has stakeholders who have spent money, time and resources in the hope of success, often with little, if any, prior financial return on those investments. With a successful IPO, these founders can finally receive a major return.

-

Lower interest rates: Smaller private companies often face the hurdle of high interest rates when taking on debt. An IPO can make it easier to access affordable credit, thanks to the rigorous financial standards and audit procedures public companies must adhere to.

IPO Disadvantages include:

-

Cost: IPOs are expensive and time-consuming, and maintaining public status is costly in and of itself. For example, 83 per cent of CFOs interviewed globally estimated spending over US$1 million on one-time costs associated with an IPO, excluding underwriter fees. Additional fees can add up to an average of US$4.2 million. Further, 66 per cent of CFOs expect to spend an extra US$1 million to $1.9 million a year beyond what they would spend if private on the requirements attached to public status.

-

Transparency: Public companies are required to follow rigorous regulations that include disclosure of key financial information, as well as other business data. This information can help competitors, and tight regulations can increase legal risks.

-

Risk of failure: IPOs aren’t a guaranteed success. Companies run the risk of not raising as much as expected if the public market doesn’t accept the initial share price — that can be a very public misfire.

-

Less control: Going public usually means business owners lose control of the decision-making process. New shareholders get voting rights and can effectively control company direction via the board of directors. This can lead to decisions that don’t mesh with the founders’s ideals, or leadership rigidity can stifle growth opportunities. While there are ways business owners can maintain control while going public, investors frown on it, and only the hottest companies can get away with it.

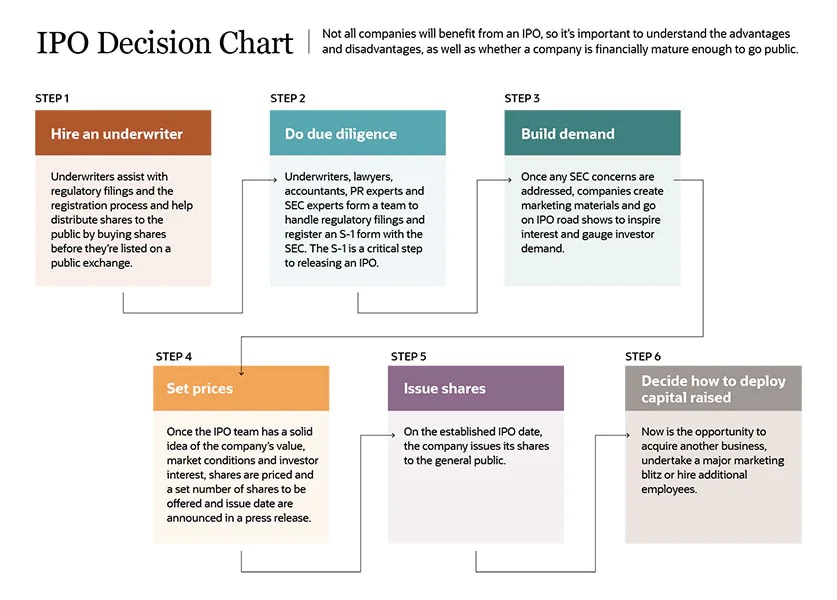

The IPO Process (or Procedures)

Before a business can consider an IPO, it needs to determine whether it’s ready. This includes understanding not only the state of the stock market — which constantly changes — but the competitive landscape and why it wants to go public.

It must also be sure that it can handle the cost and of its ability to secure a strong financial future. Once a company decides to go public, it will follow a few critical steps to release an IPO:

-

Choose the underwriters: The first step is to hire a lead investment bank (or banks) to underwrite the IPO. Underwriters assist with the securities registration process and ultimately help distribute shares to the public by putting up a sum of money to fund the IPO and buying shares before they’re listed on the public exchange. In other words, underwriters become owners of the shares, assume legal responsibility for them and then sell them to the public. However, companies must meet underwriter requirements, such as having predictable and consistent revenue, a low debt-to-equity ratio, room for growth and enough cash to fund the IPO process.

-

Do their due diligence: Underwriters, lawyers, accountants, public and investor relations teams and regulatory experts all work together to handle regulatory filings. This includes compiling all necessary documentation, like financial statements, management background, past legal issues and the prospectus, among others. They’ll look for good corporate governance and rigorously accurate financial recording. All of this is used to file a prospectus with the local market’s financial regulator. An IPO’s prospectus details key company information, like intent, finances, growth opportunities and risks. The securities body then investigates the company to ensure everything checks out.

Every stock exchange has different rules and steps for companies preparing for an IPO, available on the respective websites as below:

- Australian Securities Exchange (ASX)

- Singapore Exchange (SGX)

- Hong Kong Exchange (HKEX)

- Philippines Security Exchange (PSE)

- New Zealand Exchange (NZX)

-

Market the IPO: After all regulatory concerns have been addressed, companies create promotional materials to gauge demand and eventually establish a final offering price. Throughout this process, it’s not uncommon to make adjustments to the share price and issue date. Companies might also go on an “IPO roadshow,” a series of presentations set in various locations to pitch the IPO and inspire interest among institutional and other big investors.

-

Price the shares and announce the IPO: Share prices depend on factors like the value of the company, marketing and road show success, the economy and market conditions. Shares are generally offered at a discounted rate to ensure a successful public market debut. Once the final price, number of shares and issue date are set, the company will release an official press release to announce the IPO.

-

Issue the shares: The company issues its shares on the established IPO date. On the first day of trading, stock is available to the general public. Prices are generally volatile at first because it’s difficult to assess demand for newly public stocks.

How to Buy IPO Stock

IPO stock can be highly sought after, depending on market conditions, the level of hype around the company’s industry and business prospects and initial share-price discounts. But for individual retail investors looking to buy IPO shares, the process is a bit different from logging into a brokerage account and putting in an order, for two reasons. First, not all brokerage firms handle IPO orders, and second, many firms have eligibility requirements.

Brokerage firms limit who can participate in IPOs because the demand often exceeds the number of shares available.

If your brokerage firm does handle IPOs, eligibility usually entails having a high minimum account value or having conducted a certain number of trades within a specified timeframe — the idea is to generally limit IPO trades to experienced traders or higher-net-worth investors who understand the risks involved.

If you are eligible to participate in an IPO, it’s important to do your due diligence by reading the company’s prospectus to understand the business, how it’s run, its target market and competitive landscape and potential risks.

If you do participate in an IPO and successfully purchase shares, many brokerage firms discourage certain actions. For example, they may restrict your ability to participate in future IPOs if you sell your new shares within the first few days of trading, a practice known as “flipping.”

Pros and Cons of IPO Investing

When a company decides to go public, the likelihood of future growth is generally high. But there are still risks for those who decide to invest in an IPO, and promising companies sometimes struggle after going public. Thus, it’s important to consider the pros and cons of IPO investing before purchasing shares.

Pros:

-

Making money: IPO companies often have high growth potential. When they’re successful, investors can reap big returns, even in the short term.

-

Long-term benefits: IPOs offer investors the opportunity to invest in a company early in its lifecycle, potentially leading to major returns over the long haul. These returns can be used toward life goals like retirement or purchasing property.

-

ETFs are available: Instead of purchasing shares from one company, investors may be able to invest in Exchange Traded Funds (ETFs) that offer exposure to many different IPOs, a diversified approach that mitigates risk.

Cons:

-

Risk: Since private companies have less historical data, the decision to purchase shares involves a number of unknown variables. This makes IPO investing more speculative than most types of investments.

-

Volatility: Prices can fluctuate, especially for companies that recently went public. Seeing prices plummet can cause people to invest with their emotions and sell stock — only to find prices generally stabilise over time.

-

Not ideal for inexperienced investors: Investors and media might heavily speculate on a company’s decision to go public, building hype and increasing an investor’s desire to get in on an IPO. But IPOs aren’t always the best choice for new investors due to the risks involved.

6 Key Considerations for IPO Performance

The success of an IPO is always uncertain, but there are a number of factors that can affect IPO performance:

-

Capital raised: The amount of capital a company raises in its IPO can have a direct effect on the effort’s success. If it prices its shares too high or doesn’t sell enough, for example, it may not get the returns it expected and therefore may not be able to achieve its growth goals.

-

Valuation: Generally speaking, the greater the demand for shares, the higher the valuation for the company. However, some companies become overhyped and overvalued, leading to stock prices that plummet below the issue price shortly after going public.

-

Timing: Markets are always in flux, making timing a crucial factor in determining an IPO’s success. During favourable market conditions, investors are more likely to buy in. But the market can change quickly, and if a company cannot react just as fast to changes — up to and including postponing its IPO until investors regain confidence — it may struggle.

-

Length of lock-up period: Lock-up agreements are legal contracts between underwriters and company insiders that prohibit the sale of shares for a specified period of time — anywhere from three months to two years, but usually about six months. When the lock-up period expires, it’s not uncommon for stocks to take a downturn as more shares come into the market.

-

Flipping: Often discouraged by brokerage firms, flipping is the process of reselling an IPO stock within the first few days of purchase in order to turn a quick profit. The practice is common when new stocks are volatile. For example, stocks might be purchased at a discounted price, then sold when prices jump — sometimes all within the same day.

-

IPOs over time: While IPOs often have volatile opening day returns, prices generally stabilise. Still, a company’s long-term success will be measured not only by the success of its goods and/or services, but on its ability to meet commitments, work with shareholders and adhere to market standards and regulations throughout its lifecycle.

Prepare for an IPO With Accounting Software

Before a company goes public, it must be able to provide the detailed financial records required by auditors and regulators. The need for speed in financial reporting grows once a company is public — compounding the need for accuracy and precision — thanks to requirements to release quarterly earnings and other significant financial reports.

Because of the stringent standards of financial markets regulators, dealing with this level of financial scrutiny can be extremely challenging without highly capable accounting software. Or even better, as part of an integrated enterprise resource planning (ERP) solution that automatically compiles all of the business data helpful for releasing a successful IPO.

For example, the right accounting system can help CFOs easily organise finances and produce records. Companies planning to go public must have at least three years of audited financial data. ERPs are capable of providing that financial data quickly, while offering insights that can be used to demonstrate the organisation’s financial health. After going public, companies must have access to robust financial reporting and analytical capabilities that promote continued growth and meet stringent reporting requirements.

Put simply, legacy systems and manual accounting processes lack the features and reporting capabilities a business needs to transition from private to public.

Getting ready for an IPO is a long, complicated and costly process. But understanding how the process works can ease a company’s transition into public markets. One of the most important steps for companies to take before going public is to get their financial houses in order — a process that can be vastly easier with automated accounting software.

#1 Cloud ERP

Software

IPO FAQs

Q: What is IPO in investment?

A: An IPO, or initial public offering, is a way for a private company to publicly issue shares that can be traded on a public stock exchange.

Q: Should you buy IPO stock?

A: Whether you should buy IPO stock depends on your investment goals and experience. IPO stock can be lucrative, but IPOs aren’t guaranteed to succeed and can be a risky investment.

Q: Which IPO is best to buy today?

A: If you plan to buy into an IPO, the best stock depends on your investment goals and risk tolerance. To choose the best IPO, do your due diligence and try to find objective research on the company. This can be challenging because private companies generally aren’t transparent, but the prospectus required of any company planning an IPO can provide keen insight into its business and the risks it faces. It’s also a good idea to choose a company that’s engaged a strong underwriter with a good reputation.

Q: How do I find new IPO stocks?

A: IPO investors can find upcoming IPOs on stock exchange websites like the SGX, ASX NYSE and NASDAQ, as well as news websites with a financial focus, like Yahoo Finance.