Business process automation (BPA), where technologies like virtual agents or cognitive engines built into software take over routine tasks, makes companies more efficient and agile. In the past few years, in fact, BPA projects have taken off, driven by leaders whose organisations are on the fast track to digitisation—or who just want to free their people up for more creative, high-value pursuits.

BPA is not a specific technology or finite project. Rather, it’s an ongoing process of using technology to automate manual workflows, removing humans from the picture partially or completely. Most companies start with simpler tasks, like first-line customer service or T&E (travel and expense) routing, and progress from there once employees gain comfort.

Increasingly sophisticated software workflow engines are enabling companies to automate almost any type of horizontal business process, including demand planning, revenue forecasting, marketing, ERP, CRM, customer service and HR. Likewise, more advanced AI and machine learning, big data and robotic process automation (RPA) capabilities are enabling exciting industry-specific vertical BPA projects.

Let’s look at some of the more promising areas.

Automation Market

- Key stat: 29% of businesses in the Asia Pacific Region have fully automated at least one function. —McKinsey

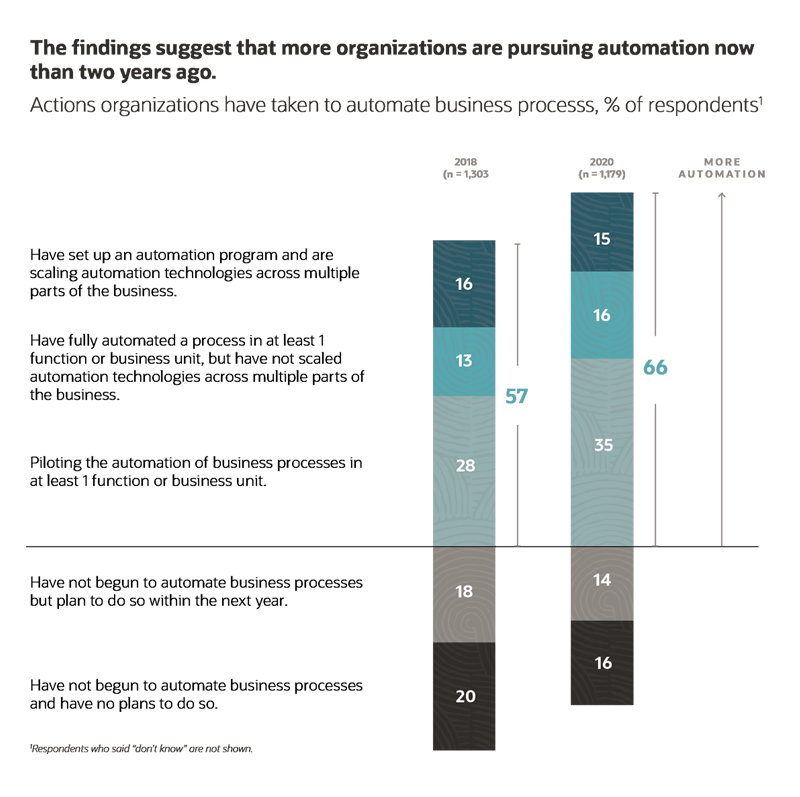

A 2020 global survey of business leaders from a wide cross-section of industries conducted by McKinsey & Co. found that 66% were piloting solutions to automate at least one business process, up from 57% two years earlier.

The percentage of companies that have fully automated at least one function, however, has grown more modestly, from 29% in 2018 to 31% in 2020.

Among companies that have successfully completed BPA projects, McKinsey says common threads include involving employees in training the automation systems and erring toward over-communicating: “Respondents from companies with successful efforts are seven times more likely than others to say they formally involve the communications function while implementing automation efforts, and they are more than twice as likely to say the HR function is involved.”

That makes sense, because employees worried about automation making them redundant will at best have lower morale; at worst, they may attempt to subvert the effort.

Artificial intelligence (AI) and machine learning have provided further fuel for market advances in automation, enabling commercially viable products and services that can automate a growing number of routine business processes. For example, modern SaaS (software-as-a-service) solutions offer a simplified approach to automating manual processes and workflows throughout an organisation and across businesses.

The tasks companies tend to automate first are routine processes that involve repetitive functions, such as routing customer queries and purchase orders, generating reports and automating routine steps in AP (accounts payable) processing. In fact, many companies start their BPA initiatives in finance, often with accounts payable automation.

AP teams first replaced recurring, manual, paper-based functions with digital records routed for approval electronically—managers authorised to approve requisitions in a workflow received email alerts or prompts to log in to a system and review forms. Now, advances in automation and machine learning make it even easier to fully automate the approval process based on predefined rules and policies. In the Asia Pacific region (APAC), companies are moving toward automation in payroll processing, customer support, new employee onboarding, order processing, SMS and email monitoring, and CRM, according to GlobalData.1

Deloitte has recognised that a lack of knowledge is one of the largest obstacles in preparing workforces for a digital future.2 In APAC, just over a third of companies have made training for automation open to all employees, recognising the importance of improving employee capabilities going forward.3

As automation continues to embed itself into the everyday operations of businesses, it’s clear different countries are considered prepared to different extents. Australia, Singapore, Japan and Korea are leading the Asia-Pacific region in preparedness, according to Deloitte. 4

Read more:

McKinsey & Co.: The imperatives for automation success

McKinsey & Co.: The automation imperative

NetSuite: 10 Accounts Payable Automation

Best Practices

Business Process Management vs Business Process Automation

- Key stat: Only 38% of executives reported their organisations had high expertise in integrating AI to automating business processes. – Deloitte5

Business process automation (BPA) and business process management (BPM) are related but not the same. BPM is considered a business practice that involves a formalised, organisational methodology based on an established path for efficient and effective management of all processes.

According to the University of Melbourne, BPM aims to increase the effectiveness, efficiency and compliance of organisations, and is a key contributor to the overall productivity and competitiveness of a business.6 Before automating processes, BPM also improves them—a crucial step to avoid simply moving flawed routines from manual to automated executions.

Business process management was a $3.38 billion market in 2019, and Mordor Intelligence projects a CAGR of 6.26%, with sales reaching $4.78 by 2025. Mordor’s 2020 forecast also points to the impact of COVID-19, which has exposed weaknesses in many companies’ supply chains and business processes.

Although BPM is a business practice, those implementing it use specialised BPM tools to model their processes and then optimise, automate and measure them. In fact, “automation” is the operative term when it comes to recurring tasks that require some form of decision-making.

BPA is complementary to, and has interdependencies with, other forms of automation that are also taking off:

- Robotic process automation (RPA) uses bots to mimic routine cognitive human tasks. In the Asia-Pacific, 68% respondents to a Shared Services and Outsourcing Network (SSON) survey reported having one RPA tool installed, and 32% reported having two or more. 7

- Digital process automation (DPA) is a relatively new variant of BPM that is more lightweight and requires less coding. In 2019, DPA was a $7.8 billion market; it’s forecast by Mordor Research to grow at a CAGR of 13%, reaching $16.12 billion by 2025. Mordor expects the Asia Pacific automation market to grow at a CAGR of 12.19% from 2021 to 2026.

Read more:

Deloitte: Talent and Workforce Effects in the Age of AI

Mordor Intelligence: Business Process Management Market - Growth, Trends, And Forecasts (2020

- 2025)

Grand View Research: Robotic Process Automation Market Size, Share & Trends Analysis

Report

Demand

- Key stat: The supply chain management (SCM) software market of APAC is expected to grow at a CAGR of 13.2% from 2018-2024. Research and Markets 8

The key to effective supply chain management (SCM) is demand planning, the process of accurately predicting which goods customers will order, and at what volume. Overestimating demand results in excess inventory, while underestimating leads to lost sales and dissatisfied customers.

Factors that can influence demand forecasts include weather, economic climate, tariffs, currency fluctuations and a variety of other disruptions. Some can be factored in with solid product portfolio management and forecasting, but manual estimates are laborious.

Enter modern ERP systems, which include SCM automation capabilities that deliver real-time decision-making for demand planning. Advances in AI, machine learning and predictive analytics and the use of sensors also provide much better visibility.

Read more:

Research and Markets: Asia Pacific Supply Chain Management Software Market Analysis

(2018-2024)

Revenue Recognition

- Key stat: The global market for accounting software is forecast to grow at a CAGR of 8.5% from 2018 to 2026, achieving 19.59 billion in value at the end of the period. The APAC region is the fastest growing market globally. —Mordor Intelligence 9

Revenue recognition automation capabilities in accounting software are designed to offload manual tasks involved in gathering and calculating when revenue is recognised. In addition to simplifying the process, automating revenue recognition cycles reduces the risk of errors and fraud, ensures compliance and speeds decision-making by providing data in near real time.

With the APAC region exposed to shifting regulatory frameworks, that’s incredibly important. Revenue recognition practices are diverse across the region and accounting software makes it easier to compare practices across entities, industries, jurisdictions and markets while bringing more useful, thorough information to financial statements.

Automation will make compliance easier and more accurate. No wonder the global market for accounting software is forecast to grow at a CAGR of 8.5% from 2018 to 2026 — companies that don’t automate will soon be at a disadvantage.

Read more:

Mordor Intelligence: Accounting Software Market - Growth, Trends, Covid-19 Impact, and

Forecasts (2022 - 2027)

Productivity and Time Management

- Key stat: Only 24%, 20% and 19% of APAC workers say that they feel productive, motivated and happy respectively, all of the time at work. —Salesforce 10

Improving worker productivity is a top driver for technology investments, including automation. But results have been mixed.

Practitioners in APAC have indicated that the most common benefits of automation have been increases in process efficiency, followed by higher accuracy. Of those surveyed, 34% noted an increase in process productivity, and 25% thought it assisted in human productivity and workload management.11 While these responses clearly connected automation and productivity, 25% is still a relatively low figure; There are fundamental issues holding back productivity. A few areas to consider:

- Willis Towers Watson has found that most APAC companies believe a positive employee experience is key to engagement, employee wellbeing, productivity and retention.12

- 30% of disengaged employees in APAC have considered leaving their current workplace within the last week, and 17% have considered it within the last 2-4 weeks.13

- The mean time APAC workers consider lost to outdated and inefficient workplace technology is 57 minutes.14

- The productivity software market, which includes office and collaboration applications, was forecast to reach nearly $62 billion in 2020, with revenue predicted to increase at a CAGR of 6.8%, reaching $85 billion by 2025, says Statista.

Automation projects can lead to increased engagement by shifting to technology the sort of rote tasks that keep people from picking up more interesting work or devoting time to skills development exercises that may boost productivity.

McKinsey estimates that, in about 60% of occupations, at least one-third of workday activities could be automated. When considering productivity and time management, not to mention payroll, tax compliance and reporting and AP, ensure automation is part of the conversation.

Read more:Willis Towers Watson: Almost 9 in 10 employers in Asia Pacific prioritise employee experience for post-pandemic success

Salesforce: The APAC Employee Engagement Report

Statista: Productivity Software Market Outlook

AI & Machine Learning

- Key stat: Revenues from AI in the Asia Pacific only continue to rise, with projected figures of12.4 million in 2025. —Statista15

Advances in AI and machine learning are key enablers of BPA. While people tend to use the terms interchangeably, that’s incorrect.

AI is the overarching science of creating intelligent software, bots and machines that can take on the decision-making and problem-solving functions performed by humans today.

Machine learning is one of many subsets of AI but the most critical because it employs algorithms and neural networks to gather massive amounts of data, including telemetry from sensors and other endpoints, to make decisions and/or execute tasks.

Other fast-maturing forms of ML- and AI-driven automation include natural language processing (NLP), robotic process automation, virtual agents (conversational interfaces), autonomous vehicles and human-like robots. Industries that have emerged as aggressive adopters of AI include financial services, IT and cybersecurity, insurance and pharma.

Still, use of true AI in BPA is relatively low, though it has accelerated considerably in recent years, with enterprise AI adoption up 25%, according to McKinsey’s 2019 Global AI survey. Trends observed across Asia, Australia and New Zealand by ManageEngine,16 in surveying executives and technology professionals have revealed:

- In Singapore, the increasing use of business analytics has been attributed by 69% of those surveyed to improving the use of available data, then improving decision making (60%) and then making decisions faster (56%).

- In Australia and New Zealand, 89% of respondents believe the use of business analytics has increased over the last two years.

- In India, 93% of respondents believe that the use of AI has delivered measurable results within their business.

As the COVID-19 pandemic of 2020 unfolded, many organisations accelerated their AI implementations. Three months after the outbreak, McKinsey conducted a survey with 800 participants, comprising Chinese, Australian and Indian executives among their main respondents.

Since the outbreak, the survey found that 88% of finance and insurance executives and 76% of those in IT have accelerated their implementations of automation and artificial intelligence. These industries were already leaders in the shift to automation and digitisation before the pandemic. Hence, companies in these sectors were well-positioned to accelerate their implementations.

A Deloitte survey of 1,900 companies confirms some trends around use of AI to improve operations and decision-making while reducing the time spent on mundane tasks.

Respondents ranked the Top 9 benefits AI has delivered:

- Enhance products and services: 43%

- Optimise internal business operations: 41%

- Make better decisions: 34%

- Automate tasks, enabling employees to become more creative: 31%

- Optimised external processes: 31%

- Create new products: 28%

- Pursue new markets: 27%

- Capture and apply knowledge that is hard to otherwise attain: 26%

- Apply automation to reduce headcount: 24%

Read more:

McKinsey & Co: 2019 Global AI Survey

McKinsey & Co.: What 800 executives envision for the postpandemic workforce

Deloitte: Talent and workforce effects in the age of

AI

Statista: Revenues from the artificial intelligence market in Asia Pacific, from

2016 to 2025

ManageEngine: The 2021 digital readiness survey

Workflow & Automation

- Key stat: Digitisation and a focus on streamlining business processes is accelerating demand for modern workflow automation management systems, a market with a CAGR of 24.5% from 2017 to 2023 in the APAC region. —KBV Research17

Companies have used software to automate business workflows for decades, but AI allows rules engines to replace manual approvals by triggering events automatically.

Modern workflow management solutions use machine learning to improve on how companies automate such processes as approving sales discounts, authorising employee T&E expenses and intelligently responding to customer queries. Digitisation and a focus on streamlining business processes is accelerating demand for modern workflow automation management systems, particularly in China, where Grandview predicts the economic development and the rising adoption of technology across industries will continue to facilitate growth.18 More broadly, the Asia-Pacific region is expected to exhibit the highest CAGR from 2021 to 2028 according to Grandview.19

One popular project: Bringing automation to the supply chain.

- In late 2019, a report forecast that the supply chain AI market was poised to grow at a CAGR of 39.4% through 2027. But months after the COVID-19 pandemic struck, Meticulous Research raised that forecast to an even more eye-opening 45.3%, with the market reaching $21.8 billion in less than seven years. Again, the APAC region will be a top performer, predicted by Meticulous Research to achieve the highest CAGR from 2019 to 2027. 20

Read more:

Grand View Research: Workflow Management System Market Size, Share & Trends

Analysis

Meticulous Research: Artificial Intelligence (AI) in Supply Chain

Market

Big Data

- Key stat: Big data and analytics spending is set to grow with a five-year CAGR of 15.6% over the forecast period of 2019-2024 in the Asia Pacific. —Back End News21

The key to successful BPA is the ability to capture all the data relevant to the entirety of a business process. Given the complexity of some processes, that requires the ability to parse massive amounts of structured and unstructured information—big data.

Fortunately, advances in big data processing are giving companies confidence in automated decision-making.

- Big data is also the underlying engine that enables AI, which drives advanced BPA initiatives. The International Data Corporation predicts that the total of all income generated from big data and analytics solutions will hit US 1.7 billion in the APAC region.22

- Spending in big data and analytics in the Asia Pacific is dominated by banking, discrete manufacturing and professional services, who are utilising the solution to support customers and clients interactions, automating business operations and preventing fraud.23

- Japan and China are leading the APAC region, expected to spend 12.4 billion and 11.9 billion respectively in the market in 2021.24

Robotic Process Automation (RPA)

- Key stat: The Asia Pacific region accounts for around 17% of the global market for RPA services. —Forrester25

RPA is the automation of repeatable human tasks with software-based robots, commonly known as “bots.”

Each bot, once programmed with machine learning and rules engines, performs a task that was once executed by a human. While most of us think of customer service chatbots here, a growing horizontal market for RPA is in automating financial reporting processes.

RPA could save finance teams 25,000 hours of avoidable rework from human errors, at a cost savings of $878,000, according to research firm Gartner. Additionally, according to Deloitte, financial services face much lower relative risk when automating when compare to other industries.26

The analyst firm, which is forecasting that the worldwide RPA market will reach 1.9 billion in 2021 also predicts that:

- 90% of large organisations throughout the world will have adopted RPA in some form by 2022.

- Organisations will triple the capacity of their existing RPA portfolios.

- The impact of COVID 19 will see providers encourage clients to pursue RPA solutions, to deal with fluctuating external factors.27

- Prices for RPA software will decrease 10% to 15% by the end of 2020 and 5% to 10% in 2021 and 2022.

Worldwide RPA Software Revenue (Millions of U.S. Dollars)

| 2019 | 2020 | 2021 | |

| Revenue ($M) | 1,411.1 | 1,579.5 | 1,888.1 |

| Growth (%) | 62.93 | 11.94 | 19.53 |

Source: Gartner (September 2020)

That suggests that this is a great time to explore the technology. CFOs may want to partner with the heads of marketing and HR for pilot tests.

Read more:

Gartner: Robotic Process Automation Can Save Finance Departments 25,000 Hours of

Avoidable Work Annually

Gartner: Worldwide Robotic Process Automation Software Revenue to Reach Nearly $2

Billion in 2021

HR Automation

- Key stat: Over half of HR executives surveyed globally believe HR will lose relevance if businesses fail to modernise their approach and to plan for the future needs of the workforce. —KPMG 28

The global market for human resources management software is on the upswing. Also known as human capital management (HCM), modern cloud-based HRMSes use analytics to model everything from compensation and benefits to employee performance and allocation of labour. Investments in HR technology will soar between 2020 and 2022, according to a report by Gallagher, an insurance brokerage, risk management and consulting firm.

In a study conducted by KPMG, it was found that almost half of the HR companies surveyed expected data modellers and scientists to be among their top three most significant roles in the coming years.

Additionally, according to the findings:

- 40% of respondents believed their companies investment in HR technology was driven by enhancing analytics capabilities.

- 35% of respondents expected to experiment with new automation strategies, such as using AI, within a 3-year timeline.

- 60% of respondents believed that pursuing these strategies would require significant changes to existing HR roles.

Many companies are failing to capitalise on the benefits of automation for HR departments, in improving retention and their own productivity.

Attracting and retaining top talent, developing employees to reach their potential and automating tasks to improve the work experience were the top HR technology concerns in PwC’s 2020 HR Technology Survey, and AI can help with all of these.

It appears that companies are listening: Among the 600 HR and IT executives PwC surveyed, 74% expect to increase HR technology spending. Likewise, 72% said their core HR applications will be cloud-based by the end of 2020.

Read more:

Gallagher: 2020 HR Technology Pulse Survey U.S. Report

PwC: HR Technology Survey 2020

Marketing Automation

- Key stat: The Asia Pacific is the fastest growing Marketing Automation software market for 2021-2027. —Mordor Intelligence

Marketers are all about adding new customers and gaining more business from existing buyers, along with establishing and maintaining brand awareness.

How that happens depends on the company and its customers. Is spending most effective on traditional advertising though various media, or is direct outreach via mail, email, web and social media the way to go?

Automation and advances in omnichannel marketing technology have enabled personalised and interactive forms of engagement, such that companies don’t need to guess, or even choose. They can take an “all of the above” tack using marketing automation software that mechanises repetitive tasks, helps marketers customise and automate entire campaigns and provides data and results analysis.

In its report on the marketing automation software market, Mordor Intelligence adds that adopters find value in gathering leads and presenting personalised offers.

Read more:

Mordor Intelligence: Marketing Automation Software Market - Growth, Trends, Forecasts (2020 -

2025)

Improve Expense

Management

Efficiency

Customer Service Automation

- Key stat: Personalisation is the key driver of customer experience excellence in Singapore, according to KPMG. Automating customer services allows businesses to more efficiently and effectively personalise the customer experience.29

Customer service has evolved significantly through the incorporation of virtual agents and digitised services in many organisations. Services that were once a novelty are now considered a common, bare-minimum provision in the offering of an organisation that customers have come to expect.

Synergy, an Australian energy provider, is one of many companies that plans to continue its investment in IQ bots and virtual agents, reducing human interactions in the provision of its end-to-end services. This strategy allows the company to reduce errors, increase their profitability and better manage the instability of COVID-19 on their industry.

However, in reducing reliance on customer service representatives, there are still challenges and risks for businesses. Companies are advised to screen chatbot vendors carefully, ask about plans for voice-enabled bots and budget for ongoing maintenance and improvements.

Read more:

Salesforce: The State of CRM in Asia Pacific: Top trends and opportunities to know

now

Finally, don’t think that BPA is only, or even mainly, for large companies. Smaller businesses can leverage automation in a wide spectrum of functions, from employee scheduling and expense management to call centres and the supply chain.

Footnote:

1 https://techwireasia.com/2020/06/get-ready-for-the-rise-of-intelligent-rpa-in-apac/

3 Robotic Process Automation: Tactical Problem-Solving Giving Way to Strategic Transformation, SSON

6 https://cis.unimelb.edu.au/information-systems/bpm

8 https://www.researchandmarkets.com/reports/4606880/asia-pacific-supply-chain-management-software

9 https://www.mordorintelligence.com/industry-reports/accounting-software-market

11 Robotic Process Automation: Tactical Problem-Solving Giving Way to Strategic Transformation, SSON

15 https://www.statista.com/statistics/721750/asia-pacific-artificial-intelligence-market/

16 https://www.manageengine.com/the-digital-readiness-survey-2021/index.html#

18 https://www.grandviewresearch.com/industry-analysis/workflow-management-systems-market

19 https://www.grandviewresearch.com/press-release/global-digital-transformation-market

20 https://www.meticulousresearch.com/product/artificial-intelligence-ai-in-supply-chain-market-5064

21 https://backendnews.net/apac-big-data-analytics-solutions-revenue-to-grow-by-41-9-billion-by-2024/

22 https://www.idc.com/getdoc.jsp?containerId=prUS48165721

23 https://www.idc.com/getdoc.jsp?containerId=prUS48165721

24 https://www.idc.com/getdoc.jsp?containerId=prUS48165721

25 https://www.forrester.com/press-newsroom/the-state-of-rpa-maturity-in-asia-pacific/

28 https://home.kpmg/xx/en/home/insights/2019/11/the-future-of-human-resources-2020.html

29 https://assets.kpmg/content/dam/kpmg/sg/pdf/2020/10/customer-experience-excellence-report-2020.pdf

30 Robotic Process Automation: Tactical Problem-Solving Giving Way to Strategic Transformation, SSON