Financial statements are a standardised set of reports that communicate financial information to stakeholders both inside and outside of a company. These statements are important to businesses of all sizes — investors and lenders use them to make decisions, and company managers depend on them as a starting point for business analysis and future budgets — so getting them right is a priority.

The challenge for most businesses is how to routinely produce, and for public companies, publish, their financial statements in a timely and efficient manner using the fewest resources. Fortunately, flexible financial software has replaced generating financial statements from leather-bound ledgers, seven-column accounting worksheets and spreadsheet applications.

What Is a Financial Statement?

Financial statements are reports that summarise a company’s accounting data in a standardised way. They’re meant to enable comparisons over time and with other companies. Each financial statement is a standalone report with a unique purpose, but they are most useful when read together, since they are interrelated.

The standard formats and conventions for each statement are included in the International Financial Reporting Standards (IFRS) and the country-specific standards based on them, including the Australian Accounting Standards. A public company’s statements must comply with those standards. Some large public companies choose to produce different editions of their financial statements, depending on which countries or regions they operate in. It should be noted that while the IFRS standards and their international derivatives are not used in all countries, such as the United States, which relies on the Generally Accepted Accounting Principles (GAAP), they are required in more than 140 jurisdictions around the world, including throughout the Asia Pacific region.

Private companies are freer to adjust financial statements to their business needs, but they usually shouldn’t stray too far from the conventions expected by finance professionals who may someday be reviewing their statements to, for example, determine creditworthiness.

Key Takeaways

- The core financial statements required under the IFRS and related standards — income statement, balance sheet, cash flows and a statement of changes in equity — are standalone but interrelated, standardised reports.

- Lenders, investors and compliance agencies use them because they show a company’s profitability, net worth and liquidity and solvency.

- Internal processes like financial modelling, budgeting and forecasting use financial statements as a starting point.

- The standard accounting and reporting rules that govern financial statements for all companies make them a valuable tool for comparisons, but they can require significant company resources to compile.

- Preparing accurate, auditable financial statements is considered table stakes for just about all companies. Flexible, integrated financial management software can provide the right level of detail and customisation for various companies.

Financial Statements Explained

There are at least five financial statements, three of which are considered “core:” balance sheet, income statement and statement of cash flows.

- The balance sheet shows a company’s financial position at a certain point in time by listing assets, liabilities and shareholder equity.

- The income statement captures a company's revenue, expenses, gains and losses during a specific reporting period, and indicates whether the business generated a profit.

- The statement of cash flows highlights inflows and outflows of cash during a given reporting period.

For publicly-traded companies, a complete set of financial statements also includes a statement of changes in equity and “notes” pertaining to the financial statements. A statement of changes in equity is also sometimes known as a statement of retained earnings, and relates to the company’s change in earnings or profit for a given financial period.

The notes to the financial statements is a unique report that provides context to the financial statements, such as accounting methods used and supporting detail for certain balances. Financial statement notes are most often associated with public filings and audited financial statements.

Private companies may choose to produce a subset of these five statements — perhaps just an income statement for use in future planning. If the statements are produced for internal purposes only, there is often no need for footnotes or managers’ explanations. Public companies, however, may be required to publish any number of additional documents beyond these five, such as consolidated schedules and subsidiary schedules. Public companies often include a section called “Management Commentary,” in which the company’s managers explain complex or non-obvious aspects of the business or business conditions that influenced the results being reported.

Why Are Financial Statements Important for Businesses?

Financial statements provide a snapshot of a company’s financial situation for use internally and externally. They help internal managers make better-informed decisions and are often a starting place for financial analysis and modelling, especially when viewed comparatively to other fiscal periods or to competitors.

Equally important, financial statements serve as a primary information package for external conversations. Lenders, like financial institutions and corporate credit card issuers, require them during the application process and to fulfil ongoing debt covenant requirements. Investors and potential partners use them as a first step in their analyses. Further, corporate regulators mandate them for public companies.

It’s important to get financial statements right. Most companies have an accounting process that handles preparation of financial statements as part of their financial close process.

Advantages of Financial Statements

Financial statements are a useful way to summarise many key aspects of a company’s financial profile. The three core financial statements neatly present a company’s assets, liabilities, equity, revenue, expenses, profit, sources of cash and uses of cash. Financial statements provide advantages for internal management and external negotiation, and can help companies stay in compliance with other regulations.

Internally, financial statements can be a useful decision-making tool for company management. They often serve as a jumping-off point for financial analysis, modelling and forecasting.

Externally, the consistency and standardisation of financial statements assists lenders’ and investors’ decision-making. When a company needs a loan to fuel expansion, launch a new product or buy more equipment, a lending bank will typically require financial statements. Similarly, suppliers may want to review financial statements before extending credit. And potential investors, whether friends and family, private equity or public markets, will review financial statements as part of their own decision-making.

For these reasons, many compliance agencies, like national tax and revenue authorities such as the Australian Taxation Office (ATO), require financial statements from companies of all sizes, just as corporate regulators require them for public companies.

Disadvantages of Financial Statements

Even when prepared properly, devoid of fraud and errors, financial statements have disadvantages. Some stem from the technical accounting rules that govern them, such as requirements to use historical costs and ignore inflation, which may cause values on the financial statements to become obsolete over time. For example, the value of a building purchased decades ago would reflect the original acquisition cost minus depreciation, rather than its actual value in the current real estate market.

Other technical disadvantages arise when comparing financial statements that cover different time periods, especially for seasonal businesses like retail, or when comparing different companies that choose different accounting methods. Imagine the inconsistencies in a comparison of a retail business’s income statement for the quarter ended 31 December to one ended 31 March.

Financial statements also have conceptual limitations. By their nature, financial statements reflect only a company’s measurable financial transactions, ignoring certain unquantifiable aspects of its holistic value, like brand recognition, market share or customer satisfaction. Further, financial statements show past results and are not future-looking, which limits their predictive value.

3 Major Types of Financial Statements for Businesses

The income statement, balance sheet and statement of cash flows — the big three financial statements — each group and categorise information in a way meant to highlight relationships and help readers find relevant details quickly. The income statement and statement of cash flows present activity over a fiscal period, such as a month, quarter or year. The balance sheet can reflect values at any single point in time, but, like the others, the last day of a fiscal period is typically chosen. Most investors, lenders and internal managers view the income statement as most important for measuring success, although all three statements tell an important part of the financial story.

-

Income Statement: Often referred to as the “P&L” (for profit and loss), the income statement shows a company’s revenue, expenses, gains and losses, ultimately ending with net income or loss for the period covered.

-

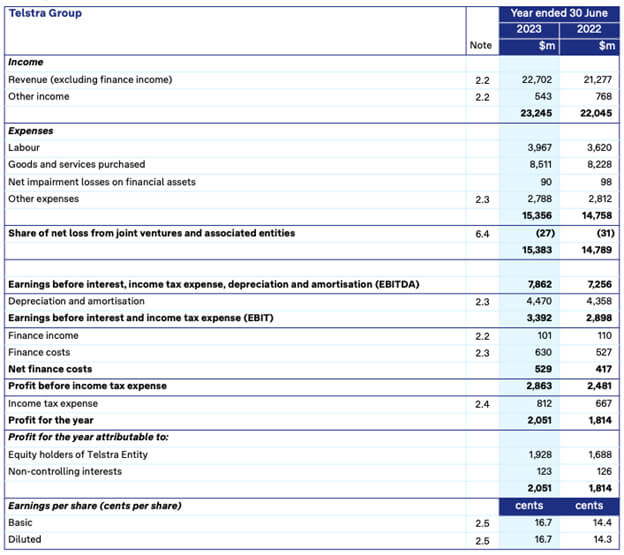

Parts of the income statement: The income statement can be presented in condensed form or in multiple steps showing different levels of detail, but it always includes revenue, gains, expenses, losses and net income/(loss). Net income/(loss) is often called “the bottom line” because it’s the last item on most income statements, although public companies add a line for earnings per share. Income statements typically show the current period results and a comparative period, such as the same quarter in the prior year or year-to-date results.

-

Income statement example: A condensed income statement from Telstra for the year ended 30 June 2023 illustrates the top level revenue and expense categories.

Here’s an example of an income statement. (Source: Telstra) -

-

Balance Sheet: This shows a company’s assets, liabilities and owner equity accounts as of a certain date. A typical balance sheet shows the current-period balances and a comparative column with the prior fiscal year end balances.

-

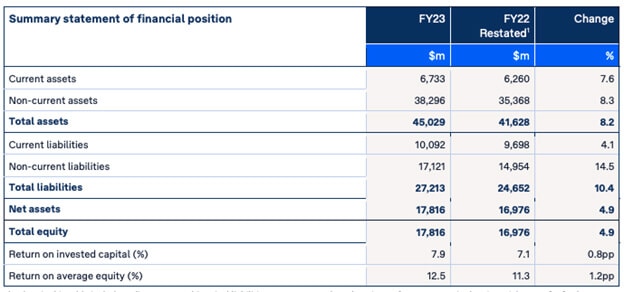

Parts of the balance sheet: The balance sheet groups assets separately from liabilities and owner’s equity. The assets section has subcategories to distinguish current assets — those expected to convert to cash within a year, such as customer accounts receivable — from non-current assets, like buildings. Similarly, the liabilities section groups current liabilities — those that are payable within the year, such as rent — from non-current liabilities, like a mortgage. The equity section reflects the company’s net worth and retained earnings, which belongs to the owners. A complete set of financial statements would include a separate statement of changes in equity for the period, which provides a detailed reconciliation of activity in the equity and retained earnings account that appears on the balance sheet.

-

Balance sheet formula: In double-entry accounting, debits and credits must always balance — in other words, they net to zero. This supports the accounting equation, also called the balance sheet equation:

Assets = liabilities + owner equity

-

Balance sheet example: An example of a condensed balance sheet from Telstra highlights the accounting equation by featuring an asset section and a section for liabilities and equity.

Here’s an example of a balance sheet statement. (Source: Telstra) -

-

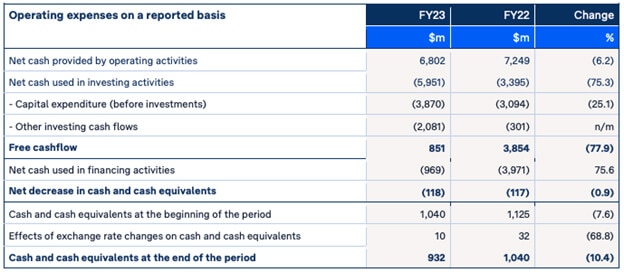

Cash Flow Statement: The statement of cash flows summarises the sources and uses of cash in a business. It provides an important perspective on the health of a company, especially small and midsize enterprises (SMEs) and early-stage businesses. Ultimately, it shows whether the company has increased or decreased its cash balances over the reporting period, helping readers evaluate liquidity, solvency and financial cushion against unexpected events. The statement of cash flows presents balances comparative to the same fiscal period in the prior year.

-

Parts of the cash flow statement: A cash flow statement begins with net income/(loss) from the income statements and adjusts for any non-cash activity for the period. A simple example is depreciation, which is a business expense involving no real cash, and so it is added back for the purpose of the cash flow statement. Non-cash activity falls into three categories based on the nature of how the cash came in or out: operating, investing or financing. Operating activities are all the transactions generated in the course of business as reflected on the income statement. Investing activities reflect changes in long-term assets and liabilities, such as purchases or sales of equipment or stocks and bonds. Financing activities show changes in the equity and debt accounts for items such as owner capital contributions, new borrowings and repayment of debt. The “bottom line” of the cash flow statement is the company’s cash balance at the end of the reported period.

-

Cash flow statement example: An example of a condensed statement of cash flows from Telstra shows the three categories – operating, investing and financing.

Here’s an example of a cash flow statement. (Source: Telstra) -

The following chart compares the three core financial statements.

The Core 3 Financial Statements Compared

| Balance Sheet | Income Statement | Statement of Cash Flow | |

|---|---|---|---|

| Purpose | Net Worth | Profitability | Liquidity & Solvency |

| Reporting Period | As of Point in Time | For the Period Ended | For the Period Ended |

| Elements | Assets Liabilities Equity |

Revenue Gains Expenses Losses Net Income |

Beginning Cash Balance Sources of Cash Uses of Cash Ending Cash Balance |

| Sections | Current Assets Non-Current Assets Current Liabilities Non-Current Liabilities Owner's Equity Retained Earnings |

Revenue Operating Expenses Non-operating Expenses Gains Losses Income Taxes Net Income |

Cash Flow from Operating Activities Cash Flow from Investing Activities Cash Flow from Financing Activities Net Increase/(decrease) in Cash |

Elements of Financial Statements

All the accounts in a company’s general ledger ultimately flow into one or more financial statements. Among the most common elements are:

-

Assets: Found on the balance sheet, assets are resources owned and controlled by a company that can provide future economic benefit. Examples include cash, accounts receivable, equipment and investments in marketable securities.

-

Income: The profit generated by the sale of goods or services, as reflected on an income statement by revenue – expenses = income.

-

Distributions: Payments of profit made to company owners, such as cash payments and cash or stock dividends.

-

Equity: The value of the company shared by its owners — in other words, its net worth after subtracting liabilities from assets.

-

Expenses: Company spending related to its operations. Examples include shipping, salaries and rent.

-

Gains: Positive impact of an incidental event, outside of operations, such as sale of old equipment for more than its value on a company’s books.

-

Investments: May be either a company’s investment in marketable securities (which is also classified as an asset) or a company owner’s transfer of value, such as cash, property or services, to make an equity investment in the company.

-

Liabilities: Obligations of the company owed to outsiders at a future date, such as accounts payables or prepayments from customers for goods or services not yet delivered.

-

Losses: Negative impact of an incidental event, outside of operations, such as the sale of old equipment for less than its value on a company’s books.

-

Revenue: Sales of goods and services from a company’s operations, sometimes referred to as its “top line.”

Using Financial Statements in Modelling

Financial modelling has many different purposes but almost always begins with financial statements or data from them. For example, “pro-forma” financial statements are models created for mergers and acquisitions to model what the combined entity might look like using various assumptions about efficiencies and changes.

Budget preparation is another example of using financial statements as a template to create a comprehensive model for future fiscal periods. Additionally, many finance teams use financial statements combined with operating data in their forecasting process to identify trends and support projections.

Financial Statement Auditing

External readers of financial statements, like lenders and investors, often require them to be audited because of the statements’ importance in their decision-making. During a financial statement audit, a certified public accountant investigates and tests the statements’ accounting data to provide a “reasonable assurance” that the financial statements are “materially” correct. The output of a financial statement audit is the Independent Auditor’s Report, which is meant to provide a level of assurance that the financial statements are free of significant misstatement. But ultimate responsibility for the accuracy of financial statements rests with company management.

Manage Your Financial Statements With Software

Large public companies such as the Fortune 500 tend to have well-resourced accounting departments handling the management of their financial statements and the complex accounting and consolidation issues such organisations face. For smaller businesses, producing and publishing accurate, reliable financial statements often means significant challenges. Studies show that shortages in staff, inadequate accounting expertise, changing regulations and insufficient technology are among the largest obstacles small and midsize organisations face in managing their financial reporting.

While financial accounting software can usually generate financial statements, most do not address all these challenges. A solution like NetSuite Financial Management, however, includes features that automate financial statement production with accounting rules built-in, can be customised for an individual business’s needs, and can even integrate information from other systems — all of which address the core of smaller enterprises’ financial statement challenges.

Financial statements are important and useful tools for internal management as well as interested external people, such as investors and lenders. The income statement, balance sheet and statement of cash flows are the most important three statements, each with their own purpose and elements. Standardised accounting guidance helps make financial statements useful and consistent across different businesses. But the rules require specialised accounting expertise. Still, producing financial statements that are accurate and auditable are table stakes for most companies. Producing them efficiently with the right level of detail and customisation for various stakeholders is a challenge best served by flexible, integrated financial management software.

#1 Cloud

Accounting

Software

Financial Statements FAQs

What are the four basic financial statements?

The four basic financial statements are the income statement, balance sheet, statement of cash flows and statement of changes in equity. Companies that produce all four generally also produce the fifth: the “notes” to the financial statements. Public companies are required to publish all five.

What are the five financial statements?

The five basic financial statements are the income statement, balance sheet, statement of cash flows, statement of changes in equity and “notes” to the financial statements. Often referred to as “footnotes,” the notes to the financial statements is a written document that provides context to the financial statements, such as accounting methods used and supporting detail for certain balances.

What is the purpose of the three major financial statements?

The three main financial statements — the income statement, balance sheet and statement of cash flows — present a standardised summary view of the financial position of a company.

How do you do financial statements in accounting?

Financial statements follow standard formats to summarise accounting data in a meaningful and intuitive way. They are prepared using standardised formats defined in national standards derived from the International Financial Reporting Standards (IFRS). A certified public accountant may audit financial statements to provide assurance that they are free of material errors and misstatements.