The success of a business is often tied to maintaining a positive cash flow. This involves monitoring the cash coming in and how much is going out every day. However, constantly monitoring your cash flow every day doesn’t mean that everything will go to plan.

There are a number of ways businesses can solve these cash flow problems. One is to stay on top of invoicing, which becomes easier for businesses that move away from the traditional, time-consuming manual- and paper-based invoicing processes and implement more efficient invoice processing workflows like electronic invoicing (e-invoicing).

What is E-Invoicing?

E-invoicing (or electronic invoicing) automates the process of suppliers sending buyers an invoice using an integrated electronic format. With e-invoicing, an accounting or ERP system typically generates and/or accepts electronic invoices within an accepted standard or framework like Peppol.

With governments around the world launching initiatives to drive the adoption of e-invoicing, like the adoption of the Peppol framework for e-Invoicing in Australia and New Zealand in 2019, there’s never been a better time to take advantage of e-invoicing and improve your invoicing process.

Peppol E-Invoicing in Australia and New Zealand

Pan-European Public Procurement On-Line or Peppol(opens in new tab) is an international network owned and maintained by the OpenPeppol(opens in new tab) that allows registered businesses under its network to exchange electronic invoices and other documents.

In February 2019(opens in new tab), Australia and New Zealand announced their intention to adopt the Peppol interoperability framework for e-invoicing. Both countries have established separate Peppol authorities committed to strengthening payment practices for businesses.

Australia and New Zealand’s Peppol Authority

The Australian Tax Office (ATO), the country’s primary revenue collection agency is the Peppol authority, and in New Zealand, the Ministry of Business, Innovation and Employment (MBIE) is the Peppol authority. Both ATO and MBIE are responsible for:

- Ensuring compliance with the Peppol technical and service standards.

- Promoting the use of e-invoicing

- Approving and certifying a Service Metadata Publisher (SMP), serving as an address book containing details of the businesses who registered to receive e-invoices

- Approving and certifying Access Point Providers, a connectivity service that links business systems to the Peppol network

- Approving and certifying Peppol-ready accounting or ERP solution providers that allow business users to send and receive e-invoices through the Peppol network.

On 29 September 2020, the Australian government announced(opens in new tab) that it would mandate e-invoicing for all government agencies by 1 July 2022. It would also consult on options for mandatory adoption of e-invoicing across all levels of government and by businesses.

How Does Electronic Invoicing within the Peppol Network Work

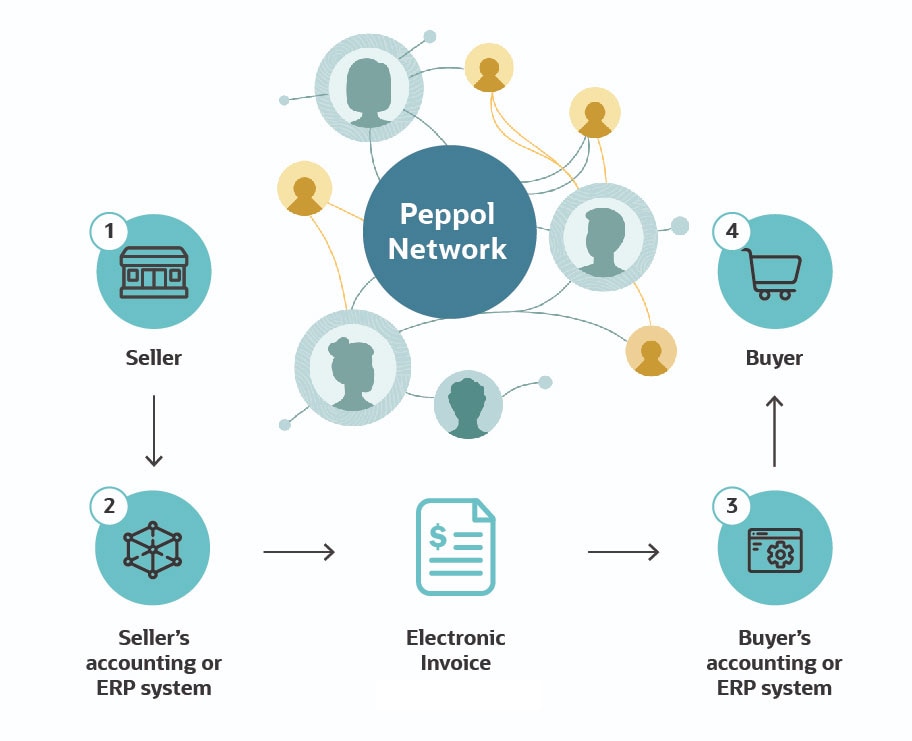

With the Peppol Network, businesses using a Peppol enabled software provider can send and receive e-invoices to one another through the Peppol network.

Documents are transferred on the Peppol network using a standard XML format called the BIS (Business Interoperability Specifications) Billing 3.0 UBL(opens in new tab), allowing the exchange of invoices even if they are not using the same accounting or ERP system. In Australia and New Zealand, this was localised to support regional tax and business requirements with the A-NZ PEPPOL BIS 3.0(opens in new tab).

This allows you to choose your preferred access point that will connect to all approved access points under the Peppol network regardless of where they are in the world.

It works based on a four-corner model involving the (1) seller, the (2) seller’s accounting system, (3) the buyer’s accounting system and the (4). In the four-corner model:

- The seller sends the invoice through its accounting/ERP system.

- The seller’s accounting/ERP system converts the invoice into the standard BIS format

- The seller’s accounting ERP system will utilise the global directory to identify the receiver’s accounting/ERP system

- The buyer receives the invoice through its accounting/ERP system

The Benefits Of E-Invoicing with InvoiceNow For Your Business

Businesses that have signed up are now able to transact with other Peppol-linked companies, enjoying a range of benefits, including:

- Sped up invoice payments with quicker receiving, capturing and processing of invoices resulting in faster payment cycles.

- More efficient finance operations by minimising tedious and time-consuming manual processes.

- Reduced business costs by eliminating paper-based invoicing transactions

- Send e-invoices globally across multiple businesses connected to the Peppol network

How to Get Ready for E-Invoicing

NetSuite SDN Partner Link4 is a Peppol ready solution in Australia. That means NetSuite customers from Australia can now take advantage of e-invoicing through the (opens in new tab)SuiteApp from Link4.

If you are currently using an accounting/ERP software, you’ll need to check if your provider is an accredited e-invoicing software in your country. Your current accounting/ERP provider should be able to advise you if your existing software will be ready for e-invoicing. To see the full list of accredited e-invoicing solutions in Australia, you may visit the ATO website(opens in new tab). For New Zealand, visit the government’s e-invoicing website(opens in new tab).

What are the e-invoicing requirements?

To use e-Invoicing in Australia and New Zealand, businesses must have a PEPPOL access point and an Australian Business Number (ABN) or a New Zealand Business Number (NZBN). The requirements are formalised with both countries under the Trans-Tasman Electronic Invoicing Arrangement of 25 October 2018.

Start e-invoicing today

Talk to us today(opens in a new tab)E-Invoicing with NetSuite and Link4

NetSuite cloud ERP manages core functions, including finance and accounting, inventory, orders and procurement giving businesses real-time visibility into their financial and operational performance.

NetSuite as a unified data platform connects all departments transforming your invoice management system from a tedious back-office function to a strategic differentiator by streamlining the receiving process. This eliminates time-consuming manual billing and collections processes, improving the collaboration between the buyer, purchaser and accounts payable.

With Peppol e-invoicing, your business can now send e-invoices to another business within the Peppol network anywhere in the world providing a faster and more secure way to send invoices instead of by email or postal mail.

This combination of NetSuite and Peppol e-invoicing eliminates the lag time between order capture, fulfillment and invoicing, compressing the order to cash cycle and reducing DSO (Day Sales Outstanding). In Australia and New Zealand, NetSuite offers integration for Accounts Receivable and Accounts Payable through NetSuite SuiteCloud Developer Network (SDN) partner Link4. By integrating NetSuite with Link4 eInvoicing, NetSuite customers can send invoices directly to another customer’s accounting system and receive invoices directly at NetSuite without PDFs, emails, and manual entry.

Who is Eligible to Apply for E-Invoicing

Businesses can apply for Peppol e-invoicing if they are using an accounting/ERP system accredited by ATO and MBIE. That means all NetSuite customers in Australia and New Zealand can now apply for Peppol E-invoicing through partner Link4.

How to Get Connected to the Peppol Network

- If you are already using an approved accounting/ERP system like NetSuite, check with your account representative(opens in new tab) how to get started using Peppol E-invoicing.

- Once your system has been confirmed, get your peppol ID from your accounting/ERP system vendor. Your Peppol ID is your unique identifier to start sending invoices in the Peppol network.

- To start sending e-invoices, you need to know the Peppol ID of the business where you’ll send the e-invoice. You can find other businesses in the Peppol network by going to the Peppol directory.

E-Invoicing FAQs

Who can register for Peppol e-invoicing?

Any business in Australia and New Zealand using a Peppol ready accounting/ERP system certified by the Australian Tax Office (ATO), the country’s primary revenue collection agency and New Zealand’s Ministry of Business, Innovation and Employment (MBIE) register for e-invoicing.

How do I send a Peppol invoice?

To send a Peppol invoice, you need to know the Peppol ID of the business where you’ll send the e-invoice. You can find other businesses in the Peppol network by going to the Peppol directory(opens in new tab).

How do I get my PEPPOL ID?

Your Peppol ID can be obtained through your Access Point Provider (AP) or the Peppol ready solution vendor.

If my client is not on the PEPPOL network, can I send them an e-invoice?

An invoice can be sent electronically, such as PDF sent by email, but this is not e-Invoicing. eInvoicing based on Peppol business document standard and operates over the Peppol global electronic network and allows enterprises to digitally transact with other linked companies on the network.

Can I send e-invoices to businesses in other countries?

Yes, you can receive and send InvoiceNow e-invoices to businesses in any other countries connected to the Peppol network. Countries who have adopted Peppol as their standard are listed on OpenPeppol website(opens in new tab).

Is e-invoicing mandatory in Australia?

No, e-invoicing is currently not required to businesses. As of 1 July 2022, only Australian Government agencies covered by the mandate are require.

Is the Invoice network secure?

Yes, the Invoice network is secure. Only certified Peppol-ready solutions are registered on the network and are authorised by the ATO and MBIE.

How long is the processing time to get started with e-invoicing?

The processing time varies and depends on the accounting/ERP system vendor. You may check with a certified Peppol ready solution vendor to get a timeline of the implementation.