“Asset” is one of those words that has both a casual meaning and a specific definition. As part of everyday speech, asset is used favourably: “He’s a real asset to the community.” But in the business accounting sense, what do finance professionals mean by assets? In that context, an asset is something of value that a company expects will provide future benefit.

Assets are a key component of a company’s net worth. Lenders may also factor in a company’s assets when issuing loans. As a note, this article only addresses company-owned assets, not Right of Use assets (i.e. leased assets).

What Is an Asset?

The International Financial Reporting Standards (IFRS) defines an asset as “a resource controlled by the enterprise as a result of past events and from which future economic benefits are expected to flow to the enterprise.”

Put another way, assets are valuable because they can generate revenue or be converted into cash. They can be physical items, such as machinery, or intangible, such as intellectual property. Assets are reported on a company’s balance sheet, one of its key financial statements.

Assets vs. Liabilities

It’s critical to understand the difference between assets and liabilities. A company lists its assets, liabilities and equity on its balance sheet. Assets are resources a business either owns or controls that are expected to result in future economic value. Liabilities are what a company owes to others—for example, outstanding bills to suppliers, wages and benefits due to employees, as well as lease payments, mortgages, taxes and loans.

As a note, for public companies, leased property and equipment is listed on the balance sheet as both an asset (Right of Use) and a liability (the present value of future lease payments). Private companies will soon be required to do the same under U.S. GAAP.

Equity is the company’s net worth—the value that would be returned to the owners or shareholders if all assets were sold and all debts were settled. The relationship between assets, liabilities and equity is defined in the “accounting equation,” one of the basic principles of accounting:

Assets = Liabilities + Shareholders’ Equity

A business with more assets than liabilities is considered to have positive equity or shareholder value. If assets are less than liabilities, a company has negative equity or owes more than it is worth.

How Assets Work

Assets underpin a company’s ability to produce cash and grow. They are categorised based on specific characteristics, such as how easily they can be converted into cash (for company-owned assets) and their business purpose. They help accountants assess a company’s solvency and risk, and they assist lenders in determining whether to loan money to a company.

Types of Assets

Assets can be classified based on a number of criteria. For companies, the correct classification is critical to financial reporting and evaluating the business’s financial health. Typically, assets are valued by the expected future cash flows they represent in their current condition, according to the IFRS.

Personal: Soft personal assets, such as intellect, wit or a winning smile are different than personal financial assets, which contribute to an individual’s or household’s net worth. Examples of personal financial assets include cash and bank accounts, real estate, personal property such as furniture and vehicles, and investments such as stocks, mutual funds and retirement plans.

Business: Business assets deliver value to a company because they can be used to produce goods, fund operations and drive growth. Assets include physical items such as machinery, property, raw materials and inventory, and intangible items like patents, royalties and other intellectual property. Companies account for their assets on their balance sheet and categorise them based on a set of criteria that reflect their liquidity, or how readily they can be converted to cash, as well as whether they are physical or nonphysical assets and how they’re used to derive value.

Convertible: Convertibility, or liquidity, refers to how readily a business can convert an asset to cash. Assets that are likely to be turned into cash within one fiscal year or operating cycle are called current assets. While any asset can be converted into cash within 12 months if the price is sufficiently discounted, current assets only include assets that are expected to be converted into cash within 12 months.

Current assets include:

- Cash and cash equivalents, such as treasury bills and certificates of deposits.

- Marketable securities, such as stocks, bonds and other types of securities.

- Accounts receivable (AR), or sales to customers on credit that must be paid in the short term.

- Inventory, or the saleable goods and materials a company has on hand.

Non-current assets are items that may not be readily converted to cash within a year. Examples of such assets include facilities and heavy equipment, which are listed on the balance sheet, typically under the heading property, plant and equipment (PP&E). Not all companies use the term “PP&E” on their balance sheet—they may instead list non-current assets under the heading fixed assets, long-term assets or simply non-current assets.

Tangible: Assets that have a physical existence are called tangible assets. They include cash, PP&E, inventory, raw materials or tools and office supplies. Tangible and intangible assets that are expected to provide an economic benefit beyond the current year, such as manufacturing equipment or buildings, are called or “long-lived” assets.

Intangible assets, as the name implies, lack a physical presence. Examples of intangible assets include right of use assets, patents, copyrights and trademarks, the value of which can sometimes be difficult to quantify.

Some tangible and intangible assets are referred to as wasting assets, or assets that decline in value over a limited life span. Tangible assets that qualify as wasting assets include manufacturing equipment and vehicles, which wear down or become obsolete over time. Intangible assets such as patents also qualify as wasting assets because they have a limited lifespan before they expire. To reflect wasting assets’ reduction in value over time, accountants reduce the assets’ value on the balance sheet by applying depreciation (for tangible assets) or amortisation (for intangible assets).

Asset Usage: Finally, an asset can be classified as operating or non-operating based on how a company uses it. Operating assets are necessary to the primary operations of a business, such as cash, inventory, factories and patents. For a mining company, heavy equipment qualifies as an operating asset, as does a manufacturer’s production equipment.

Non-operating assets are not necessary for funding business operations but have other peripheral value. Examples include short-term investments, marketable securities, interest from deposits and administrative computers.

Examples of Assets

There are a wide variety of assets that businesses might have to perform at their highest level. They include:

- Cash and cash equivalents

- Accounts receivable (AR)

- Marketable securities

- Trademarks

- Patents

- Product designs

- Distribution rights

- Buildings

- Land

- Mineral rights

- Equipment

- Inventory

- Software

- Computers

- Furniture and fixtures

Three Key Properties of Assets

For something to be considered an asset, it must have three properties:

- Ownership: First, a company must have ownership or control of the asset. This enables the company to convert the asset into cash or a cash equivalent and limits others’ control over the item. Note, right of use assets aren’t always convertible. Lease agreements often stipulate that the lease cannot be transferred or sold. The ownership property is important when considering an asset’s informal meaning versus its technical meaning. For example, companies often say their employees are their “greatest asset,” but in terms of accounting, companies don’t have true control over them—employees can easily leave for a new job.

- Economic value: Second, an asset must also provide economic value. All assets can be sold or otherwise converted to cash, except for some right of use assets such as lease agreements. In that way, assets can be used to support production and business growth.

- Resource: Finally, an asset must be a resource, which means it has or can be used to generate future economic value. This generally means that the asset can create future positive cash inflows.

Importance of Asset Classification

Properly classifying assets is important for company leaders to have an accurate picture of key financial metrics such as working capital and cash flow. Asset classification can also help a business qualify for loans—it gives the bank a clearer picture of the risk it’s taking on—work through bankruptcy and calculate tax liabilities.

Distinguishing operating assets from non-operating assets also helps organisations see how each asset type drives overall revenue.

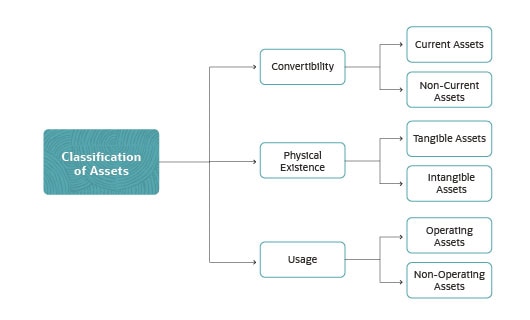

Three Classifications of Assets

Business assets can be divided into three different categories based on their convertibility, physical existence and usage. What are these three types of assets?

- Convertibility describes how easily assets can be converted to cash.

- Physical existence describes whether an asset physically exists or is intangible.

- Usage describes the purpose of an object as it relates to business operations.

How Do Assets Play Into Accounting?

Understanding and properly valuing assets is integral to accurate accounting, business planning and financial reporting. And in the case of public companies, accurately accounting for leased assets is required by law. Classifying and valuing assets is critical to understanding a company’s cash flow and working capital. Accountants have to properly classify assets for purposes such as securing credit and obtaining insurance. They also have to properly value assets in order to calculate depreciation and amortisation for tax purposes, and to enable the company to sell them if necessary.

Automated Asset Management Solutions

Keeping track of assets can be challenging given the number and diversity of assets a company may own. Automated asset management solutions offer a way to inventory, categorise and track assets in order to understand their value and plan operations efficiently. Asset management solutions can also help to track and plan the operational life cycle of an asset from acquisition to disposal, including operating and maintaining the asset. In addition, automated asset management solutions can help a company comply with shifting government or industry regulations.

Assets include almost everything owned and controlled by a company that’s of monetary value and will provide future benefit. Assets are classified by how quickly they can be converted to cash, whether they are tangible or intangible, and how a business uses them. Assets are a key component of a company’s net worth and an important factor in its overall financial health.

#1 Cloud

Accounting

Software

Asset FAQs

How can a business tell if something is an asset?

An asset is anything that has current or future economic value to a business. Essentially, for businesses, assets include everything controlled and owned by the company that’s currently valuable or could provide monetary benefit in the future. Examples include patents, machinery, and investments.

What are intangible assets?

Intangible assets are non-physical assets that provide value to a company but don’t exist in physical form. Non-physical assets include things like goodwill, reputation,patents and trademarks, royalties, brand equity, and contractual obligations.

Does labour count as an asset?

Labour is not an asset. In most cases, labour is an expense. Wages payable count as a current liability to hold salaries that are due to employees at the end of the month or whenever payday is.

What’s the difference between current and fixed assets?

Current assets are generally used up within a year and are therefore short-term. They are involved in the daily processes of running a business. Fixed assets are those that have a longer lifespan – generally over one year.